I. Outline

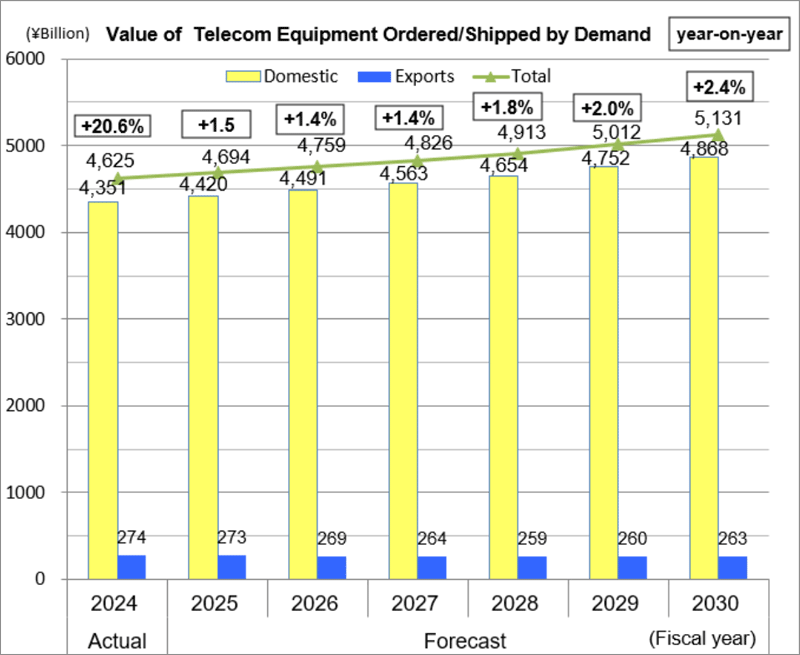

In FY2025, Japan’s economy will see a gradual recovery in real total employee income driving personal consumption, alongside a gradual recovery in corporate capital investment. Within this environment, demand will be supported by increased communication traffic driven by high-speed, high-capacity data usage from telework and video streaming services, the spread of generative AI, and the expansion of services leveraging 5G capabilities. On the other hand, exports are expected to decline slightly due to factors such as intensifying global market competition. Total demand is projected to reach ¥4.6938 trillion (a 1.5% increase from the previous fiscal year).

The rapid proliferation and scaling of generative AI are compelling the ICT industry to meet unprecedented demand and undergo transformation across three key domains: data centers, cloud services, and high-capacity communication infrastructure. It is essential for Japan’s ICT industry to seize this opportunity and make strategic investments in the foundational infrastructure for ultra-high-speed, high-capacity communications. This includes accelerating R&D for the early realization of next-generation communication technology (6G) to handle the explosive data flow of the AI era, enhancing the optical fiber networks connecting regionally distributed data centers, and strengthening and expanding submarine cables to reinforce the backbone supporting nationwide data flow. Within this context, total demand for fiscal year 2030 is projected to reach ¥5.1307 trillion (a 10.9% increase compared to fiscal year 2024, with a compound annual growth rate (CAGR) of 1.7% from fiscal years 2024 to 2030).

II. 2025 Forecast

Total demand for telecommunications equipment in fiscal year 2025 is projected to reach ¥4.6938 trillion (a 1.5% increase from the previous fiscal year). Of this total, domestic demand is forecast at ¥4.4205 trillion (a 1.6% increase), while exports are projected at ¥273.3 billion (a 0.2% decrease).

Major Equipment Categories Forecast to Grow over FY2024 (In order of yen value growth)

| 【FY2025 forecast】 | 【Increase over FY2024】 | 【Rate of growth】 | |

|---|---|---|---|

| Mobile handsets (with public phone line) | 3,251.3 billion yen | 63.3 billion yen | 2.0% |

| Base station equipment | 225.0 billion yen | 15.0 billion yen | 7.2% |

| Digital transmission equipment | 198.8 billion yen | 2.8 billion yen | 1.4% |

| Routers | 128.9 billion yen | 1.9 billion yen | 1.5% |

| LAN switches | 168.1 billion yen | 1.3 billion yen | 0.8% |

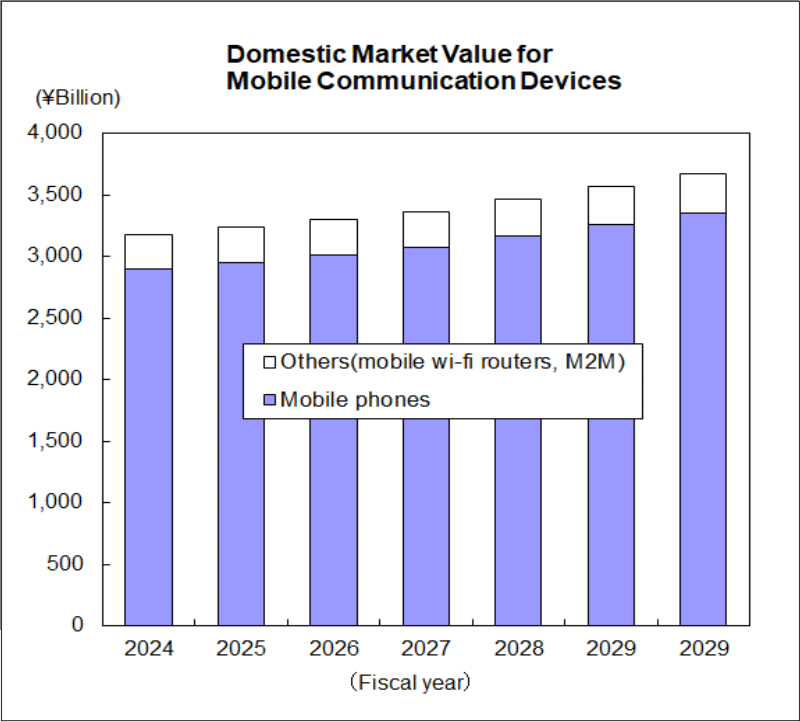

(1) Total Demand for Consumer-Related Equipment: 3.2513 trillion yen (2.0% increase compared to FY2024)

- Mobile communication terminals had seen continued restraint in purchases and prolonged replacement cycles, but demand expanded significantly in FY2024 due to a rebound effect, and is expected to continue increasing in FY2025. However, concerns over a global economic slowdown and ongoing unstable international conditions persist, potentially still posing a negative impact on the mobile terminal market.

(2) Total demand for business-related equipment: 431.2 billion yen (2.5% decrease compared to FY2024)

- Demand for push-button telephone systems, PBXs, and cordless phones for offices is primarily replacement demand. Investment in these devices is shifting toward new communication styles driven by changes in workstyles. While unit prices are trending upward, the volume is expected to decrease due to a gradual reduction in the number of units as companies slowly rebuild their communication infrastructure.

- Demand for fax machines (including multifunction devices) is projected to decline due to changing workstyles and the promotion of digitalization within companies and government ministries. Exports, which account for a large portion of demand value, are also negatively impacted by changing workstyles, similar to domestic factors. Although exports temporarily increased in FY2024, they are expected to return to a downward trend in FY2025.

(3) Total Demand for Infrastructure-Related Equipment: 567.4 billion yen (2.5% increase compared to FY2024)

- Domestic demand for digital transmission equipment and base station communication equipment is projected to increase, driven by demand to handle growing traffic and expand services leveraging 5G capabilities. Terrestrial fixed communication equipment is expected to increase due to a certain level of budget allocation for disaster prevention-related equipment for government agencies. Additionally, for core network communications, demand is anticipated for wireless backhaul and fronthaul equipment driven by improvements in 5G area coverage and the spread of SA (Standalone) mode. Satellite fixed communication equipment is also expected to increase, primarily driven by government agency demand.

- Exports: For terrestrial fixed communication equipment, exports are expected to decrease due to intensifying global market competition and the expanding market share of overseas manufacturers. For base station communication equipment, exports are projected to increase as overseas carriers continue to adopt O-RAN at a rising rate.

(4) Total demand for Internet-related equipment: 322.6 billion yen (0.7% increase compared to FY2024)

- For routers, the carrier market is expected to see continued capital investment to handle increased data traffic driven by the expansion of various services, including cloud services. The enterprise and government market is anticipated to see demand driven by changes in workstyles, the promotion of DX, web conferencing, and the adoption of 5G, Wi-Fi 6/6E, and 7. The SOHO market is expected to see continued demand for network speed upgrades and high-value-added products (such as enhanced security functions at the edge). LAN switches: Investment is expected to continue for network reconfigurations driven by increased traffic and the growing number of connected devices. Optical access equipment: A decline is anticipated to persist as a reaction to the completion of the high-speed investment cycle that accelerated during and after the COVID-19 pandemic.

(5) Total demand for Other 1 to Other 4 and telecommunications equipment components: 117.5 billion yen (0.1% decrease compared to FY2024)

III. Mid-Term Outlook

The total value of the telecommunications equipment market in fiscal year 2030 is projected to be ¥5,130.7 billion (a 10.9% increase compared to fiscal year 2024, CAGR 1.7%), with domestic sales amounting to ¥4,867.6 billion (an 11.9% increase, CAGR 1.9%) and exports totaling ¥263.0 billion (a 4.0% decrease, CAGR -0.7%).

Major Equipment Categories Forecast to Grow over FY2024 (In order of yen value growth)

| 【FY2025 forecast】 | 【Increase over FY2024】 | 【Rate of growth】 | |

|---|---|---|---|

| Mobile handsets (with public phone line) | 3,685.3 billion yen | 497.3 billion yen | 15.6% |

| Base station equipment | 254,7 billion yen | 44.8 billion yen | 21.3% |

| Digital transmission equipment | 213.3 billion yen | 17.2 billion yen | 8.8% |

| Routers | 134.4 billion yen | 7.4 billion yen | 5.8% |

| LAN switches | 172.0 billion yen | 5.2 billion yen | 3.1% |

| Fixed communication equipment | 148.4 billion yen | 1.0 billion yen | 0.7% |

(1) Total demand for consumer-related devices: 3.6853 trillion yen (15.6% increase compared to FY2024, CAGR 2.4%)

- Domestic demand for mobile communication terminals is projected to grow gradually. This expansion is driven by the appeal of AI features, the realization of massive simultaneous connections and low latency via 5G Stand Alone (SA) mode, and the gradual emergence of services unique to 5G. This includes demand for 5G terminals (and any new terminals supporting 5G services as they appear).

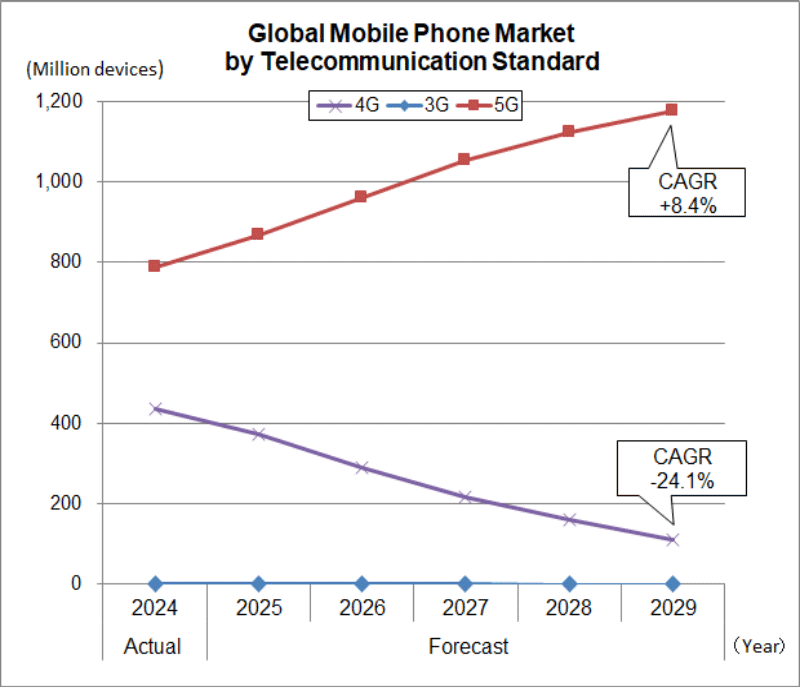

- The global mobile phone market (including smartphones) is seeing 5G service adoption primarily in developed countries, with 5G services expected to expand more widely after 2025. By communication standard, the market for 5G-capable smartphones is expected to expand, as most future smartphones are projected to support 5G. Conversely, the market for non-5G smartphones is forecast to shrink. While some migration demand from 3G will persist, the rapid replacement with 5G devices is accelerating this decline.

(2) Total demand for business-related equipment: ¥373.5 billion (15.6% decrease compared to FY2024, CAGR -2.8%)

- Button telephone systems are expected to continue a gradual decline due to the impact of cloud migration, despite steady demand from small and medium-sized enterprises (SMEs) and replacement demand from the PBX market.

- PBX systems will trend downward as replacement by higher-capacity button telephone systems and the gradual spread of voice communication infrastructure restructuring (full cloud migration) progress.

- Business cordless phones: Although substitution by smartphones is occurring, demand is expected to persist, particularly among SMEs, hospitals, and nursing care facilities. However, around 2028-2029, five years after the termination of public PHS services, procuring parts for terminals may become difficult, potentially leading to an accelerated decline from this point.

- Fax machines (including multifunction devices) are expected to see negative demand trends due to changes in work styles and the digitalization initiatives of companies and government ministries. Exports are also projected to continue declining for the same reasons as the domestic market.

(3) Total demand for infrastructure-related equipment: ¥616.4 billion (11.4% increase compared to FY2024, CAGR 1.8%)

- Demand for infrastructure-related equipment is expected to see a gradual increase in digital transmission equipment and base station communication equipment. This is driven by network capacity expansion necessitated by increased traffic resulting from the proliferation of services utilizing 5G, IoT, and generative AI.

- Base station communication equipment is projected to decline from FY2028 to FY2029 as 5G investment stabilizes, but is expected to increase from FY2030 onwards due to 6G investment.

- Fixed communication equipment is projected to increase: for terrestrial systems, due to continued demand for disaster prevention applications, 5G wireless backhaul, and front-haul; and for satellite systems, driven by government agency demand.

- Exports are expected to grow due to demand expansion from emerging markets’ 5G equipment investments and the construction of dedicated lines for businesses and factories.

(4) Total demand for internet-related equipment: ¥332.7 billion (up 3.9% from FY2024, CAGR 0.6%)

- In the internet-related equipment market, routers are expected to grow. This growth is driven by continued factors such as increased traffic due to the spread of web conferencing, diversification of video content, and the adoption of generative AI and large language models (LLMs), along with increased capital investment for faster access lines and enhanced security features.

- LAN switches are also expected to grow, driven by capital investment for network reconfiguration to handle increased traffic and the growing number of connected devices.

- Growth in optical access equipment is projected to be driven by increased demand for high-speed services due to expanding demand for large-capacity content and the need for mobile data offloading.

(5) Total Demand for Other 1 to Other 4 and Components: ¥118.2 billion (0.5% increase compared to FY2024, CAGR 0.1%)

[Forecasting Methodology]

- For domestic market forecasts, trends were analyzed based on historical CIAJ order/shipment statistics. For equipment types where overall market size could not be fully captured, estimates were derived through interviews with CIAJ members, conducted with the cooperation of the Information and Communications Research Institute, Inc.

- For global market forecasts, Omdia data and trend analyses were referenced and utilized for trend analysis.