|

Ⅰ. Overview of the Japanese Economy

Japan’s economy from April to September 2025 saw negative growth for the first time in a year and a half, with real GDP declining 0.6% quarter-on-quarter (annualized rate: -2.3%) in the July-September period (second preliminary estimate: December 8). By demand component, a significant decline in private residential investment had a major impact. Personal consumption remained positive, buoyed by robust spending on beverages (including alcoholic drinks) and food services (such as eating out) due to the impact of the intense heat. Equipment investment also stayed positive, supported by labor-saving investments driven by labor shortages and strong software investment. Exports, however, declined. This was affected by the impact of U.S. tariff policies, particularly a decrease in automobile exports. Imports also fell, driven by reductions in crude oil and natural gas.

II. Overview of the Telecom Market

(1) Domestic Market Trends

The domestic market size for the first half of fiscal year 2025 reached ¥1.8547 trillion, a 5.1% increase compared to the same period last year. The trend of expanding imports of smartphones manufactured by overseas companies continued, while domestic production saw increased output of network-related equipment, contributing to the growth in the domestic market size.

(2) Domestic Production Trends

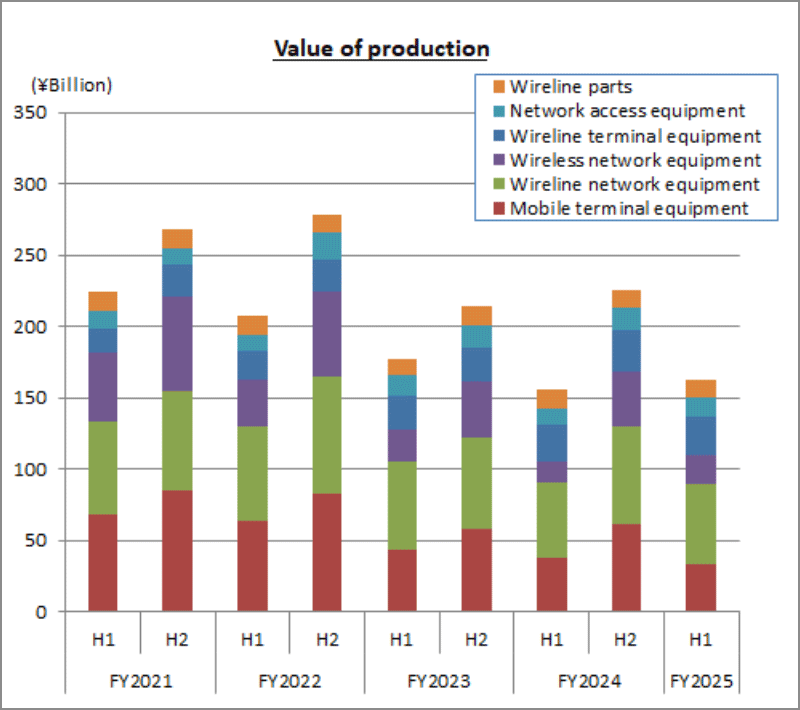

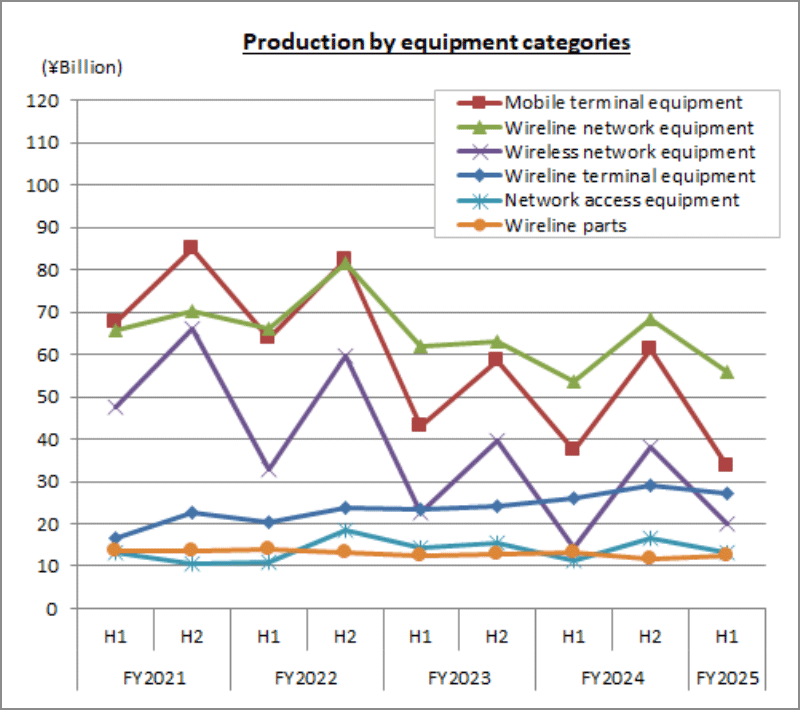

Domestic production value for the first half of fiscal year 2025 reached ¥162.3 billion, a 4.4% increase compared to the same period last year. Domestic production grew as all product categories—transportation equipment (including digital transmission equipment), fixed communication equipment, base station communication equipment, and network connection equipment—performed steadily. Fixed communication equipment saw growth due to infrastructure development by local governments for disaster prevention and recovery measures. Network connection equipment increased driven by the expansion of communication networks to meet the demand for high-capacity, high-speed transmission, fueled by the widespread adoption of cloud services and web conferencing, the expansion of services utilizing generative AI, and the establishment and expansion of data centers.

(3) Export Trends

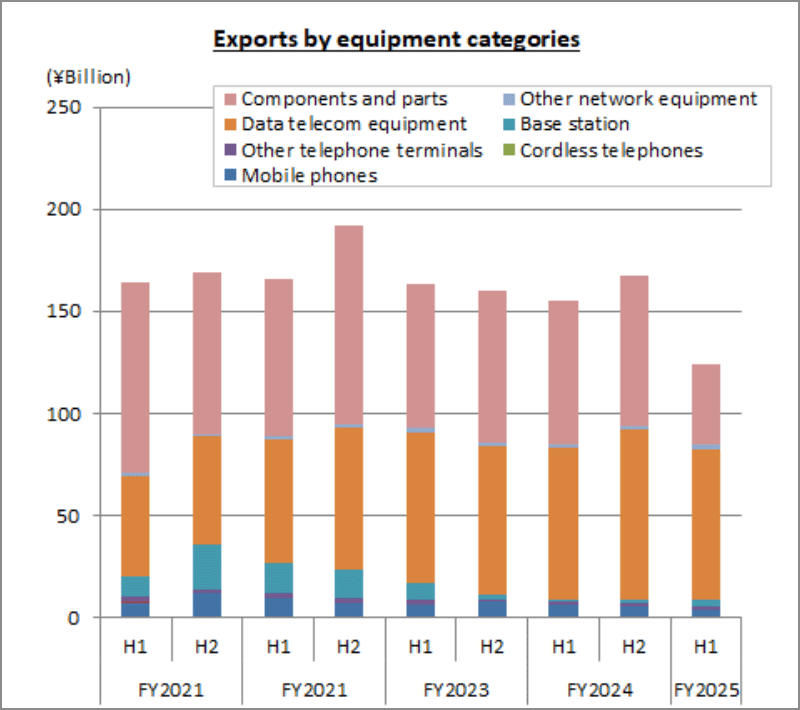

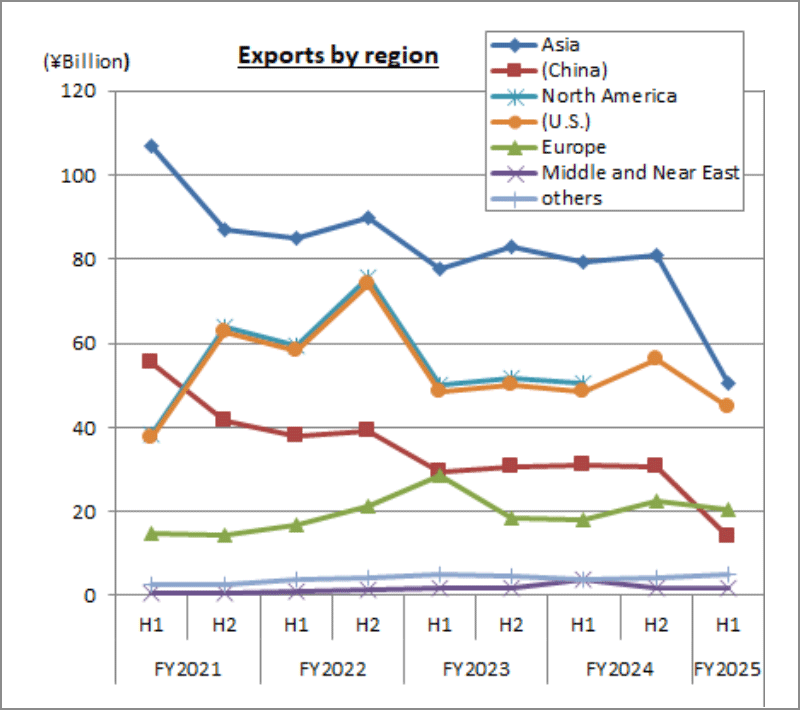

Total exports for the first half of fiscal year 2025 amounted to ¥124 billion, a 20.3% decrease compared to the same period last year. Exports of parts to Asia fell by 36.2%, with exports to China dropping by 55.1%. This decline is attributed to sluggish demand in China’s domestic smartphone market and China’s accelerated push toward domestic production of semiconductors and electronic components amid prolonged U.S.-China tensions. Changes in production patterns within China are likely impacting Japan’s supply chains.

(4) Import Trends

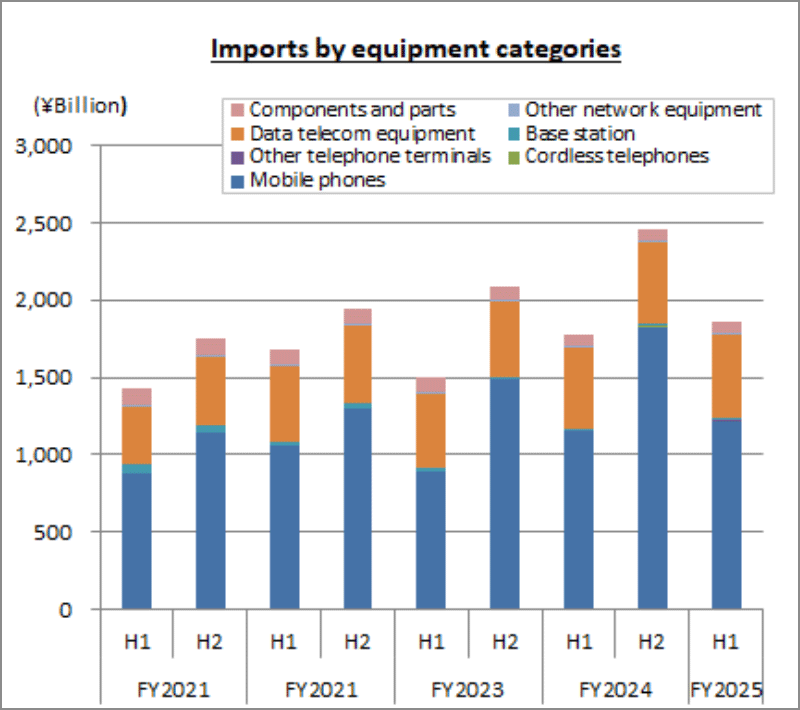

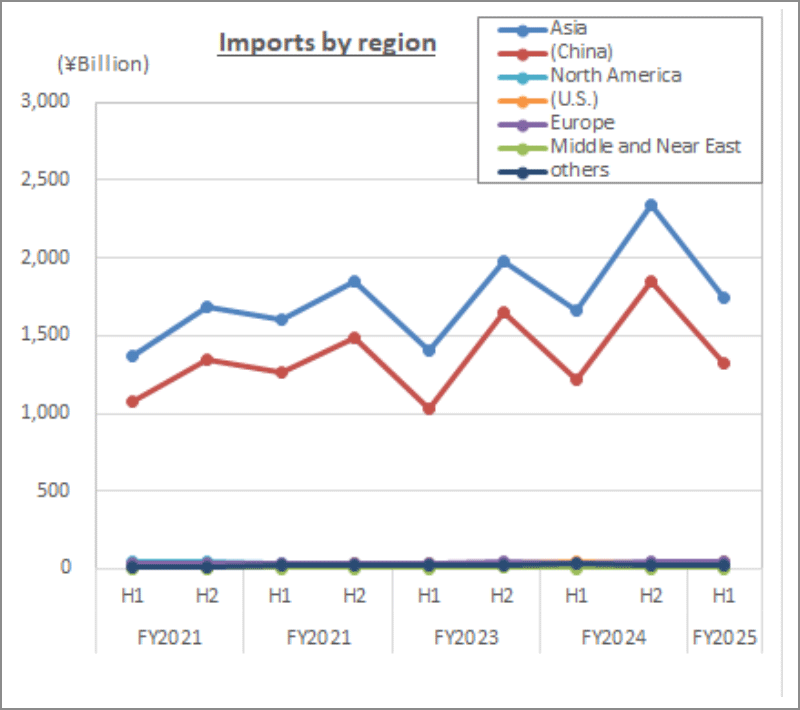

Total imports for the first half of fiscal year 2025 reached ¥1.8546 trillion, a 4.5% increase compared to the same period last year. This growth was driven by continued strong demand for overseas-manufactured smartphones, coupled with the rise of foreign vendors supplying infrastructure for domestic network expansion and data center construction.