[Overview]

In the April-June period of FY2024, the domestic telecom market grew more than expected, largely reflecting the resolution of problems regarding the procurement of semiconductors, an increase in imports of smartphones and data telecom equipment. Going forward, this will lead to an increase in telecom infrastructure-related demand if there is progress in investments in, for example, data centers with the increase in data traffic or in Sub-6 band and stand-alone base stations in association with 5G base stations. Exports declined due to the continued global economic downturn.

(1) Domestic Market Trends

The domestic market value (domestic production value – export value + import value, excluding components) amounted to 774.5 billion yen in the April through June period, a year-on-year increase of 17.5%. Imports of telecom equipment produced overseas such as smart phones, routers and switches increased, contributing to the growth of the domestic market.

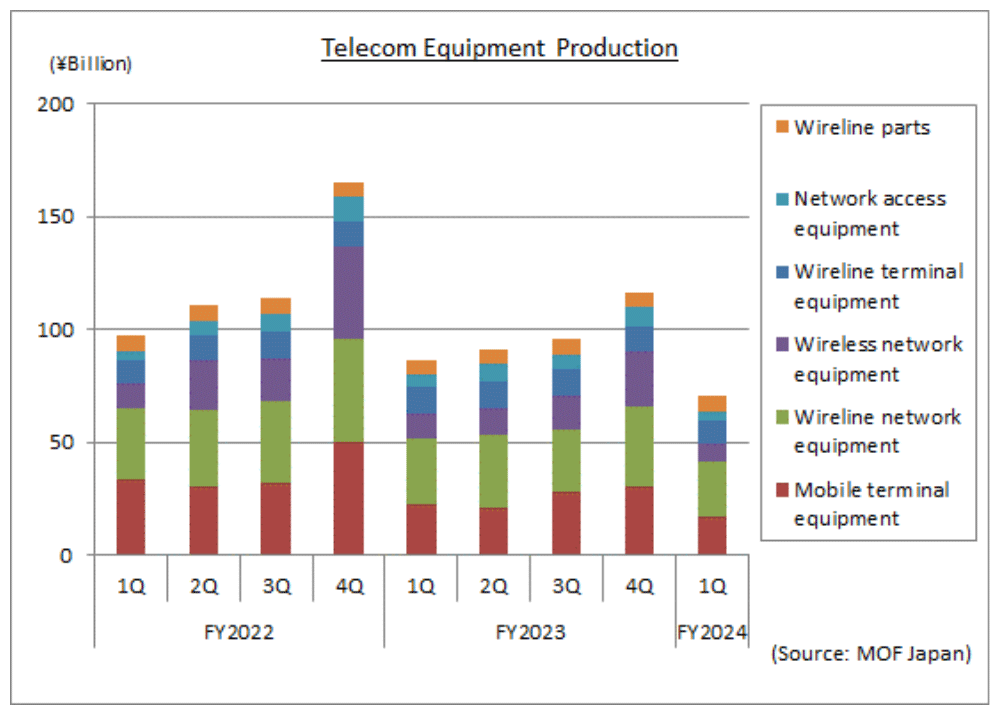

(2) Domestic Production Trends

Domestic production totaled 70.2 billion yen in April through June, a year-on-year decrease of 18.6%. Domestic production decreased for five consecutive quarters, reflecting inventory adjustments and capital investment reductions impacting a range of models in reaction to an increase in demand in the previous year, as well as lower demand attributable to the downsizing of systems and expansion of cloud services in business equipment for offices.

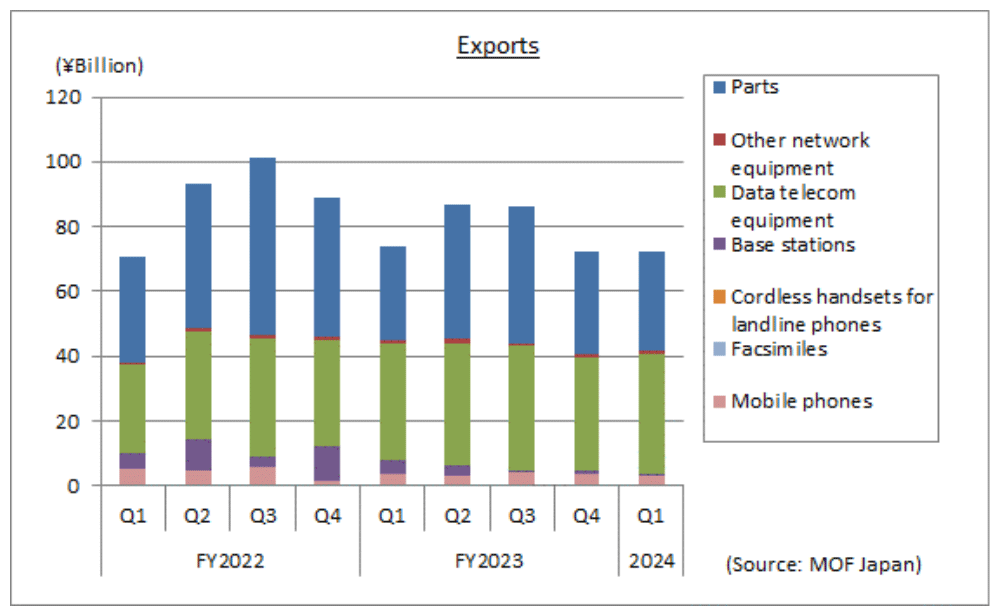

(3) Export Trends

In the April through June period, total exports amounted to 73.2 billion yen, a decrease of 2.8% year-on-year. Exports decreased for four consecutive quarters, attributable to a significant fall in exports of base stations, despite increased exports of data telecom equipment and parts.

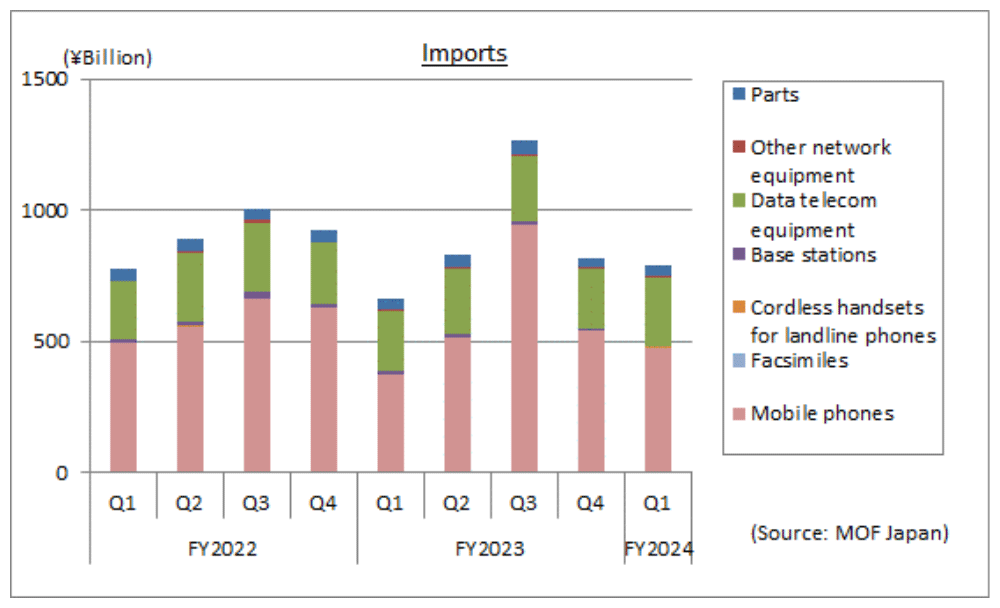

(4) Import Trends

In the April through June period, total imports amounted to 788.7 billion yen, an increase of 18.9% year on year. Imports increased for the first time in two quarters due to the strong performance of data telecom equipment, as well as a significant increase in imports of smartphones.

[Orders Received and Shipped by Japan-based CIAJ Member Companies]

Orders received and shipped by Japan-based CIAJ member companies in April through June amounted to 246.1 billion yen, down 12.3% from the same quarter of the previous fiscal year. Of which, the total value of domestic shipments was 188.6 billion yen, representing negative growth of 14.3% over the same quarter of the previous year and exports was 57.5 billion yen, representing negative growth of 5.0% over the same quarter of the previous year.

Domestic shipments decreased year on year, given decreases in terminal equipment and network-related equipment. Exports declined year on year due to a significant decrease in wireline terminal equipment, despite increases in mobile terminal equipment and network-related equipment.