[Overview]

During the period from October to December 2023, the telecom market saw a slowdown in demand for wireline network equipment, with a decrease in digital transmission equipment and base stations attributed to sluggish capital spending by carriers and others. However, imports of smartphones from overseas manufacturers increased significantly in value terms, partly reflecting the impact of a rise in terminal prices and the weak yen.

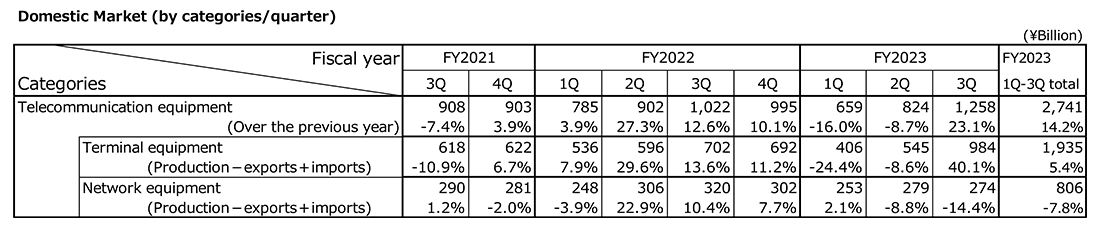

(1) Domestic Market Trends

The domestic market value (domestic production value – export value + import value, excluding components) amounted to 1,257.9 billion yen in the October through December period, a year-on-year increase of 23.1%. The domestic market value increased due in part to a significant increase in imports of smartphones manufactured overseas.

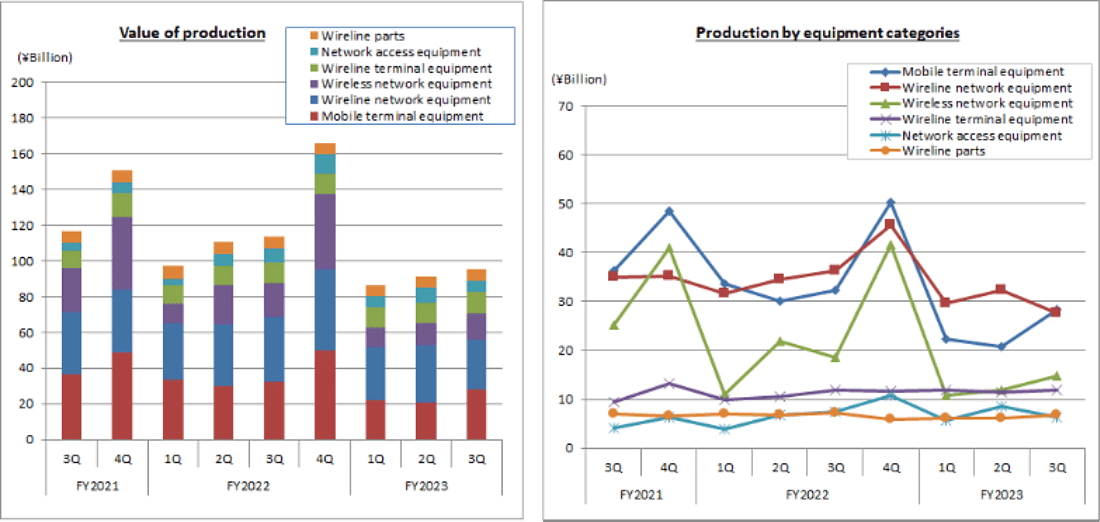

(2) Domestic Production Trends

Domestic production totaled 95.5 billion yen in October through December, a year-on-year decrease of 16.1%. It has declined for three consecutive quarters. Production value declined because demand related to wireline networks has slowed, with sluggish demand for digital transmission equipment in particular.

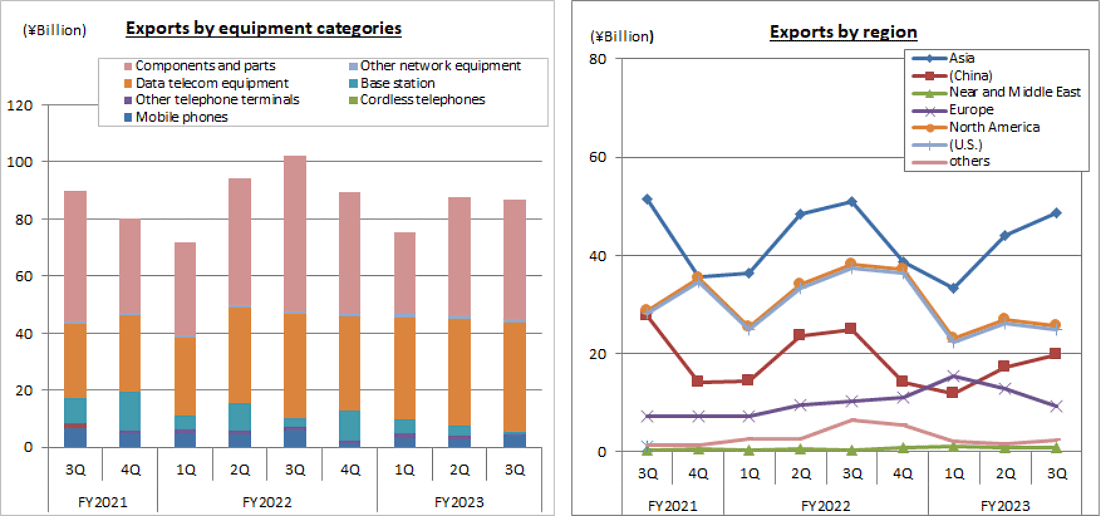

(3) Export Trends

Total exports amounted to 86.7 billion yen in the October through December period. On a year-on-year basis, they declined 15.3%, having decreased for the second consecutive quarter. While exports of network equipment continue to increase with the rise in data traffic, exports of most types of equipment decreased due to the slowdown of the global economy.

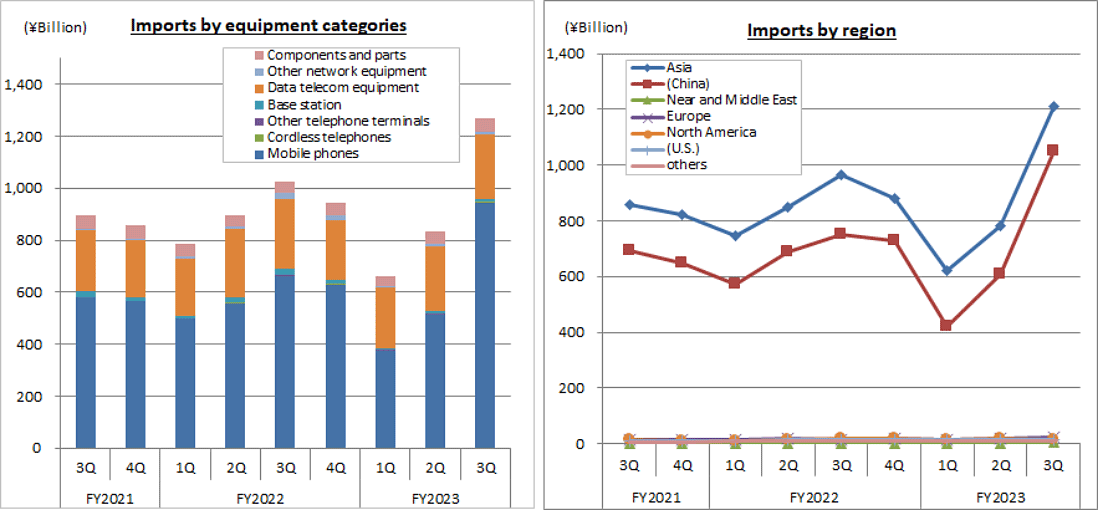

(4) Import Trends

In the October through December period, total imports amounted to 1,267.6 billion yen, up 25.5% year on year, having resulted in quarterly imports exceeding 1,000 billion yen. The import value of smartphones from overseas manufacturers increased significantly, partly reflecting a rise in terminal prices and the weak yen.

[Orders Received and Shipped by Japan-based CIAJ Member Companies]

Actual orders received and shipped in the October through December period was 272.1 billion yen, down 26.9% year-on-year. Of which, the total value of domestic shipments was 219.2 billion yen, representing negative growth of 12.0% over the same quarter of the previous year, and exports was 52.9 billion yen, representing negative growth of 57.0% over the same quarter of the previous year. Domestic shipments decreased year on year, significantly affected by declining smartphone demand. Exports of many types of equipment declined year on year due to the impact of the overseas economic downturn.