I. Overview

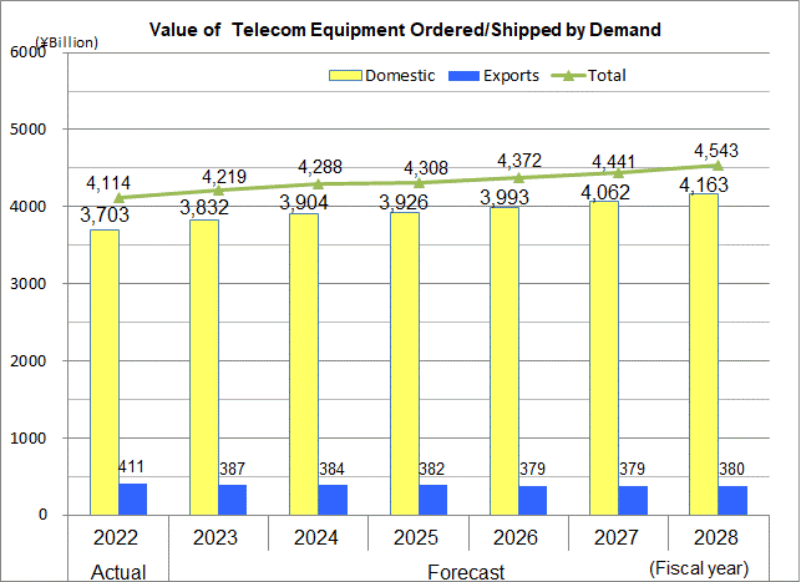

The Japanese economy in FY2021 witnessed a strong rebound from the slowdown caused by COVID-19 the previous year, but lost momentum in FY2022. However, the weaker yen and rising supply costs pushed up the price of mobile handsets, translating into higher demand figures in yen. Among enterprise equipment, recovery of component shortages – including semi-conductors, and a return to working from corporate offices led to increased capital investments. Growth of high-speed large volume data traffic from telework and video-streaming services and an easing of supply limitations contributed to demand for infrastructure/internet equipment. In total, the total demand for telecommunication equipment for FY2022 marked healthy growth amounting to approximately 4.114 trillion yen (+15.7% year-over-year growth).

Despite concerns over weaker domestic consumer spending and capital investment, as well as a backlash of the demand growth in FY2022 for some telecom equipment categories, the yen value for demand in some equipment categories will increase as the price of parts and components and transportation costs go up. Demand for some equipment categories will also rise with further growth in high-speed large volume data traffic. Total demand for telecom equipment in FY2023 is forecast at approximately 4.219 trillion yen (+2.6% year-over-year growth).

Lifestyle transformations in the post-COVID era will include application of new technological advances in 5G/local 5G and beyond 5G/6G to overcome structural societal challenges such as building digital and more resilient supply chains and easing shortages in the labor force. Promoting co-creation spanning multiple industries, including the creation of new voice and image solutions, the use of robots and IoT/AI to reduce the reliance on human labor, innovations in logistics to accommodate domestic manufacturing facilities and autonomous driving, building communication infrastructure networks to support the ever growing high-speed large volume data traffic will contribute to an enriching and comfortable living environment for Japan as well as promote a more digital and carbon-neutral society. The total telecom equipment market value is expected grow to approximately 4.543 trillion yen in FY2028, or an increase of 10.4% over the FY2022 figure.

II. 2023 Forecast

The total telecommunication equipment market figure for FY2023 is forecast at approximately 4.219 trillion yen (+2.6% over FY2022), with the domestic market accounting for about 3.832 trillion yen (+3.5% over FY2022), and exports accounting for 387.4 billion yen (-5.7% over FY2022).

(1) Consumer equipment total: 2.706 trillion yen (+10.2% over FY2022)

- Despite a decrease in the shipment of handsets due to a weaker yen and rising price of components leading to higher price tags that will cause consumers to hold back on new purchases and prolong replacement cycles, the domestic market value is expected to be higher.

(2) Enterprise equipment total: 505.8 billion yen (-6.6% over FY2022)

- Replacements are central to demand for key telephones, PBXs and office-use cordless phones and investments are shifting towards new work and communication styles. The rebound in FY2022 from the easing of the supply squeeze will be followed by a drop in domestic demand, but the total yen value is expected to grow somewhat due to rising cost of components, and thus, higher unit price tags.

- A slowdown following demand growth in FY2022 with the easing of the supply squeeze in addition to the trend of going digital contribute to the negative forecast for office-use facsimiles (including multi-functioning facsimiles). Overseas demand for multi-functioning machines takes up a large share of facsimile exports and like the domestic situation in Japan, changes in work styles abroad is expected to have a negative impact.

(3) Infrastructure equipment total: 557.8 billion yen (-17.6% over FY2022)

- Domestic demand is forecast to decrease after capital investment, mainly in 5G, by telecom carriers reached a peak in FY2022. However, higher material cost is expected to push the value upwards.

- Exports are expected to decrease slightly due to the peaking of 5G investments by carriers abroad in FY2022 despite the recovery from the semi-conductor shortage and the backlog in the supply chain from COVID-19.

(4) Internet equipment total: 320.4 billion yen (+2.5% over FY2022)

- The sudden demand for optical access equipment to accommodate the ”new normal” during COVID-19 has been winding down, but solid demand for optic fiber cables remains intact. Capital spending in routers to meet 5G network expansion and the traffic surge, mostly in mobile, will push up demand. Demand for LAN switches will also grow as facilities are enhanced to accommodate traffic growth and more IoT devices connecting to the network resulting in investment in new configurations. These trends are all expected to result in the growth in value of demand for this category.

(5) Equipment/parts categories not included above: 128.9 billion yen (+1.1% over FY2022)

III. Midterm Projection

The FY2028 total figure is projected at approximately 4.543 trillion yen (+10.4% growth over FY2022), with the domestic market accounting for about 4.163 trillion yen (+12.4% growth over FY2022) and exports accounting for 379.9 billion yen (-7.5% growth over FY2022).

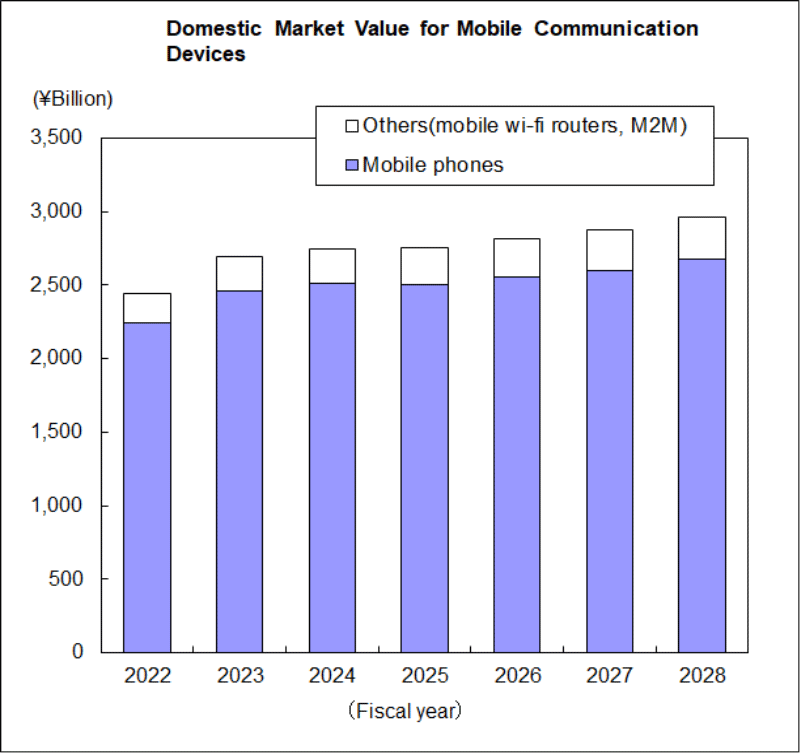

(1) Consumer equipment total 2.977 trillion yen (+10.4% over FY2022)

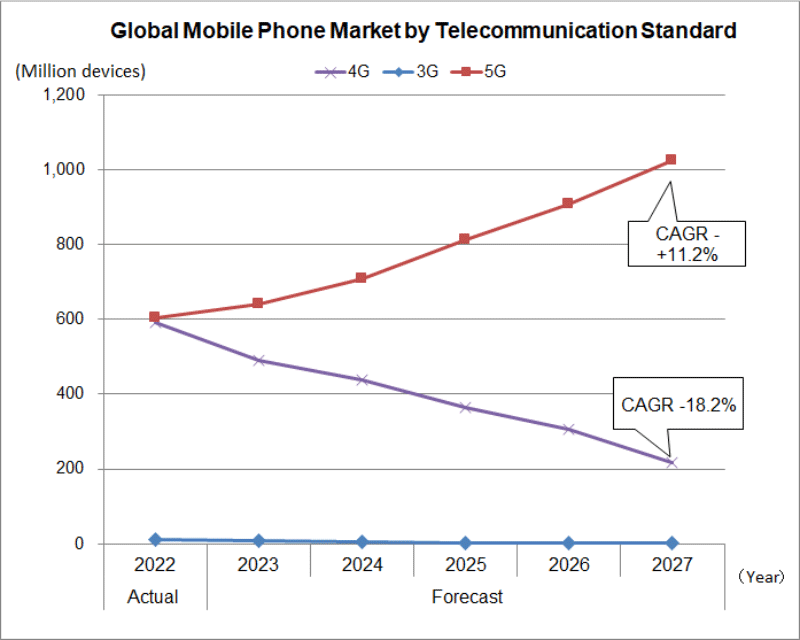

- The domestic demand for mobile communication terminals is forecast to show gradual growth with higher demand for 5G handsets from FY2026 onwards as services utilizing 5G SA format allows simultaneous access by a greater number of devices at low latency. This is despite the rising price of handsets resulting from the weaker yen and higher material costs that will cause consumers to hold back on new purchases and prolong replacement cycles.

- The global mobile phone market (includes smartphones) in 2022 shrank with the zero-COVID policy in China and concerns over geo-political circumstances combined with higher prices, stunting consumption. Continuing higher prices in 2023 and the need to shrink stockpiled inventory from the previous year will result in less shipments, but the situation is expected to improve, returning to positive growth in FY2024 onwards. Replacement demand for 5G handsets will increase after 2022, culminating in sales revenue in 2027 projected at 350.8 billion U.S. dollars (CAGR -0.03%).

(2) Enterprise equipment total: 460.7 billion yen (-14.9% over FY2022)

- Demand for PBXs and office-use cordless phones will be affected by the restructuring of voice communication platforms at offices in connection with work style transformation and further adoption of cloud services, resulting in a continued decrease.

- The domestic market for office-use facsimiles (including multi-functioning facsimiles) will continue to decline with changes in work styles and the shift to digital at both private sector and government offices. Exports are also forecast to decrease for the same reasons as the domestic market.

(3) Infrastructure equipment total: 627.4 billion yen (-7.3% over FY2022)

- Demand for infrastructure equipment is expected to show gradual growth, as networks continue to be enhanced to accommodate the surge in traffic from 5G, local 5G, IoT services, xR contents, like AR/VR and metaverse, as well as network slicing and edge computing, shifts to even more data centers with greater volume and speed capacities and demand growth for disaster information systems. There was special demand for fixed communication equipment (satellite-related) in FY2022, which is expected to result in year-to-year negative growth vs. FY2022 yen value in the following year.

- Exports are expected to continue its growth as new lifestyles take root in the post-COVID era, leading to greater network usage, traffic growth and more data centers.

(4) Internet equipment total: 348.4 billion yen (+11.5% over FY2022)

- The Internet equipment market will continue to address traffic growth from expansion of 10 Gbps optical and 5G network coverage and the further popularity of video content. Positive growth is projected for the category with video communications taking hold at businesses and corporate contents becoming richer, and as new uses of networks like 5G, Wi-Fi 6/6E, xR technologies, metaverse and wider use of digital twin computing leads to traffic growth. The return of manufacturing facilities to Japan will also likely lead to new capital investment in IT.

(5) Equipment/parts categories not included above: 129.8 billion yen (+1.8% over FY2022)

IV. Market Trends in New Businesses

(1) Background to the focus on new equipment and services

- In the past, the focus was on trends in telecom equipment used for providing fixed/mobile phone, ISDN, private leased circuit, and internet services. Telecommunication services, which used to be dedicated to providing a single type of service, have been impacted by technological innovations in ICT and the advancement of digital transformation (DX), leading to the combination of multiple services and solutions that are high-speed, large capacity, high value-added (low latency, multiple simultaneous connectivity, low power consumption, low cost, etc.) with the data processing power of AI and the storage capacity of the cloud. In addition, the use of virtual technologies in place of physical telecommunication equipment has made it possible to provide element technology functions using software on general-purpose equipment.

(2) Scope of the market

- Calculating the demand projections for equipment categories and services in order to gain an understanding of future demand trends while taking into consideration the new telecom equipment and services market are under way. These figures will not be tallied with the demand forecast in section III. When it becomes possible to determine the demand per equipment from the CIAJ orders placed/shipments statistics, they will be phased in with the respective equipment covered in the mid-term demand forecast.