I. Summary

In the telecom market from April to September 2023, prices of certain types of equipment rose on soaring prices of parts and materials. As a result, demand for these types of equipment rose in value terms.

Additionally, demand for certain types of equipment rose, reflecting an increase in high-speed, large-capacity data traffic for telework and video distribution services. Meanwhile, there was a downturn in demand for certain types of equipment following an increase in demand in FY2022, when supply constraints caused by semiconductor shortages eased. Purchases and capital expenditures declined due to the weak yen and higher prices.

(1) Domestic Market Trends

The domestic market value (domestic production value – export value + import value, excluding components) amounted to 1,482.7 billion yen in the April through September period, a year-on-year decrease of 12.1%. Carriers’ capital expenditures slowed, leading to a decline in the production and import of mobile terminals and wireless network equipment, which resulted in a decrease in the domestic market value.

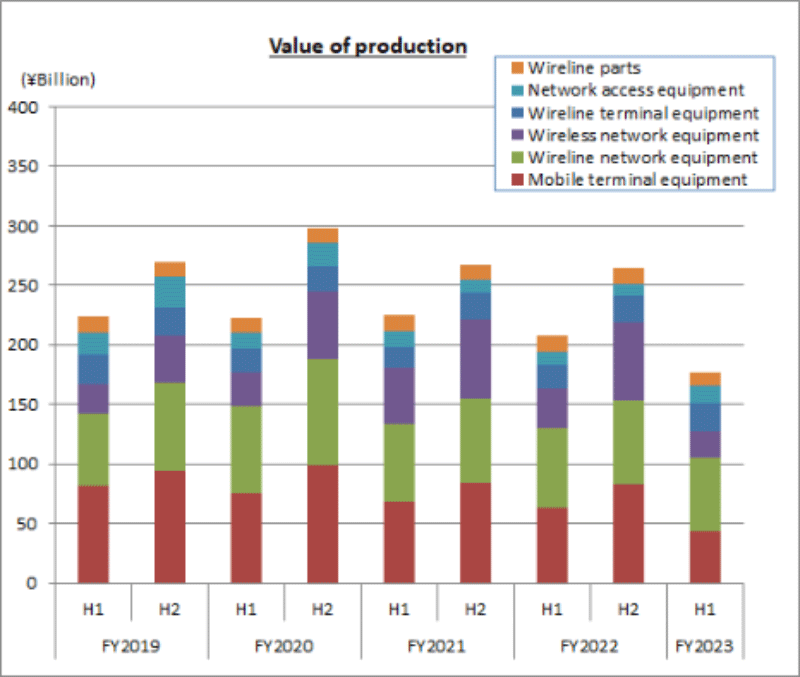

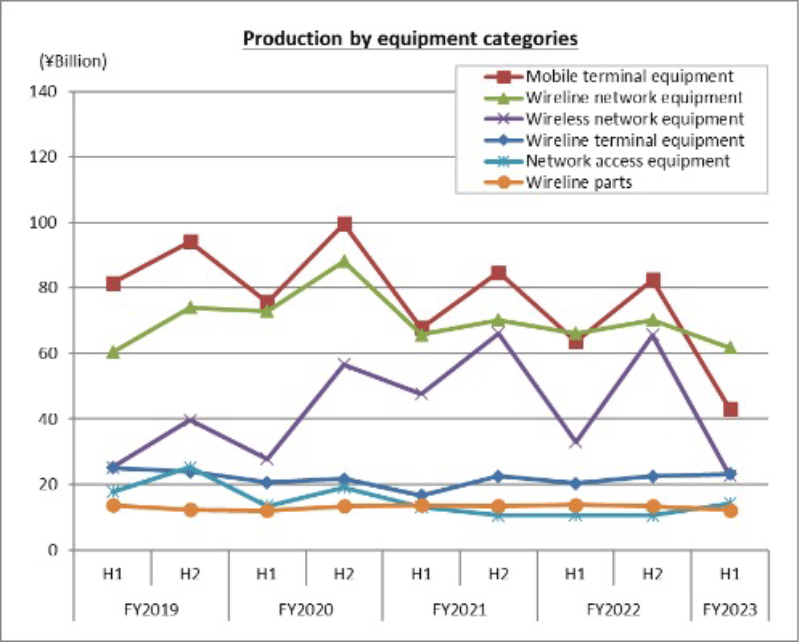

(2) Domestic Production Trends

Domestic production totaled 177.4 billion yen in April through September, a year-on-year decrease of 14.6%. The production of business-related devices increased as the difficulty in procuring parts and materials was resolved. Meanwhile, investment in communications infrastructure saw sluggish growth. Consequently, domestic production decreased.

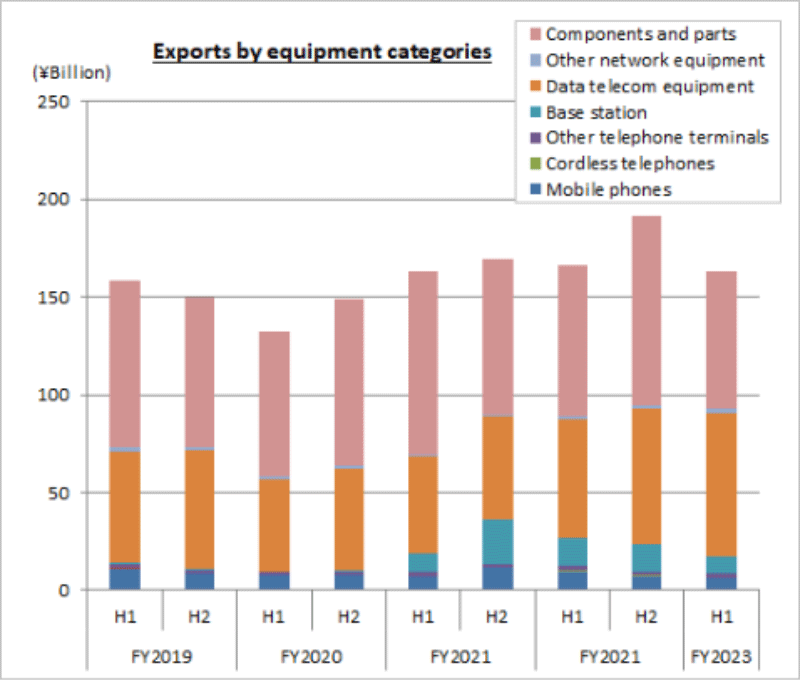

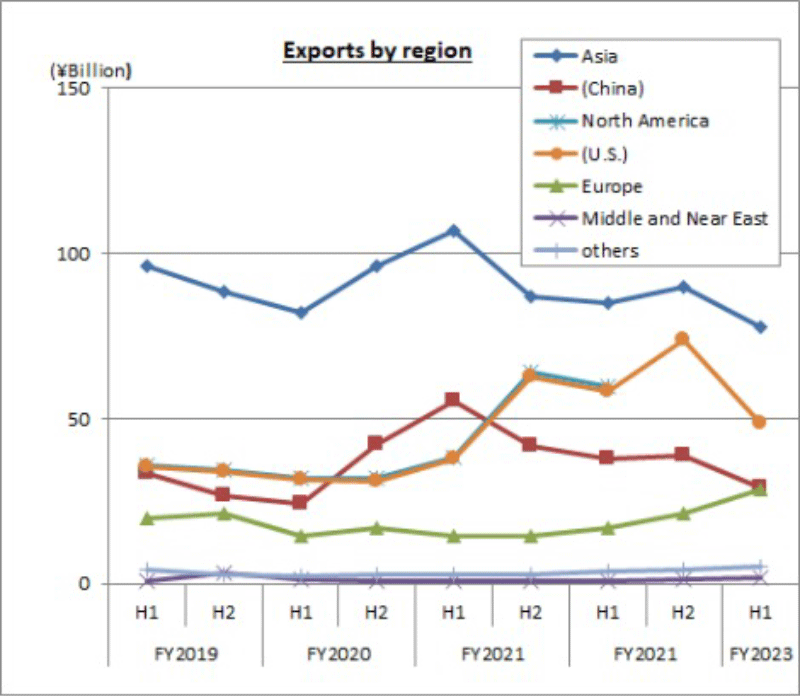

(3) Export Trends

Actual orders received and shipped in the April through September period was 163.0 billion yen, decrease 1.9% year-on-year. There was an increase in high-speed, large-capacity data traffic in overseas markets, which led to a rise in demand for systems related to wired networks. However, exports declined for the first time in five half-year periods partly due to a slowdown in the economies of the United States and Europe.

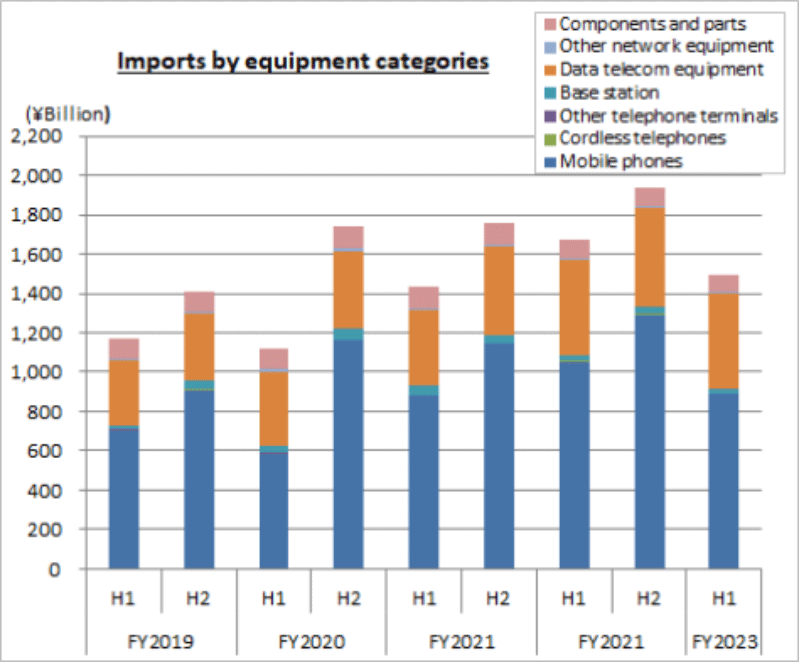

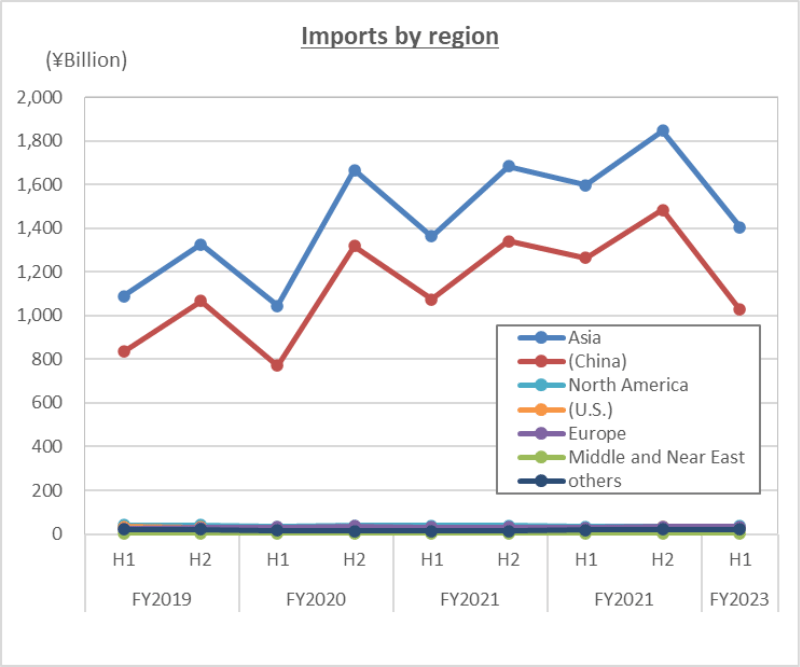

(4) Import Trends

In the April through September period, total imports amounted to1,497.2 billion yen, a 10.6% decrease year on year. Imports of data telecom equipment such as routers and switches increased. However, imports of smartphones declined, reflecting weak demand in Japan. Imports fell for the first time in six half-year periods.

II. Orders Received and Shipped by Japan-based CIAJ Member Companies

Actual orders received and shipped in the April through September period was 574.8 billion yen, down 18.4% year-on-year. Of which, the total value of domestic shipments was 452.0 billion yen, representing negative growth of 13.7% over the same quarter of the previous year and exports was 122.8 billion yen, representing negative growth of 32.1% over the same quarter of the previous year.

Domestic shipments decreased year on year due to a fall in shipments of mobile terminals and wireless network equipment despite an increase in wired network equipment. Exports of almost all types of equipment declined year on year, reflecting subdued investment due to a slowdown in the global economy.