The Communication and Information network Association of Japan (CIAJ) announces the telecommunication equipment production and trade figures for FY2023 (April-June) as follows.

[Overview]

In the April-June quarter of FY2023, the telecom market stopped short of achieving a full recovery, reflecting a decrease in the shipping quantity of certain types of equipment due partly to increased inventory in the previous fiscal year, while the shipping quantity of key telephones, intercoms and other types of equipment increased, attributable to a recovery from problems with the procurement of parts and materials, including semiconductors.

The shipping quantity of mobile phones declined significantly, reflecting a prolonged purchase replacement cycle as a result of rises in prices of terminals in tandem with high prices and surges in parts and materials prices. However, if the installation of 5G communication infrastructure with wider areas and frequency band increases in the future, it would advance the launch of mobile terminals which feature new technology and functions in response to new services, etc., and would lead to an increase in demand for mobile backhaul and other infrastructure.

(1) Domestic Market Trends

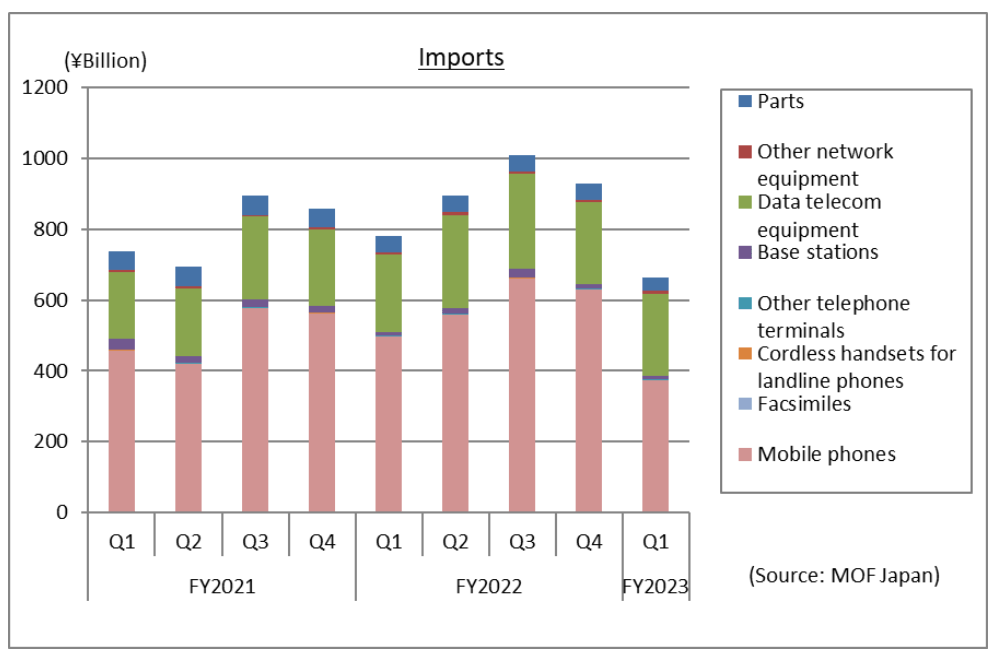

The domestic market value (domestic production value – export value + import value, excluding components) amounted to 658.9 billion yen in the April through June period, a year-on-year decrease of 16.0%. The domestic market contracted, reflecting decreases in the import and production of smartphones, etc. due to sluggish demand.

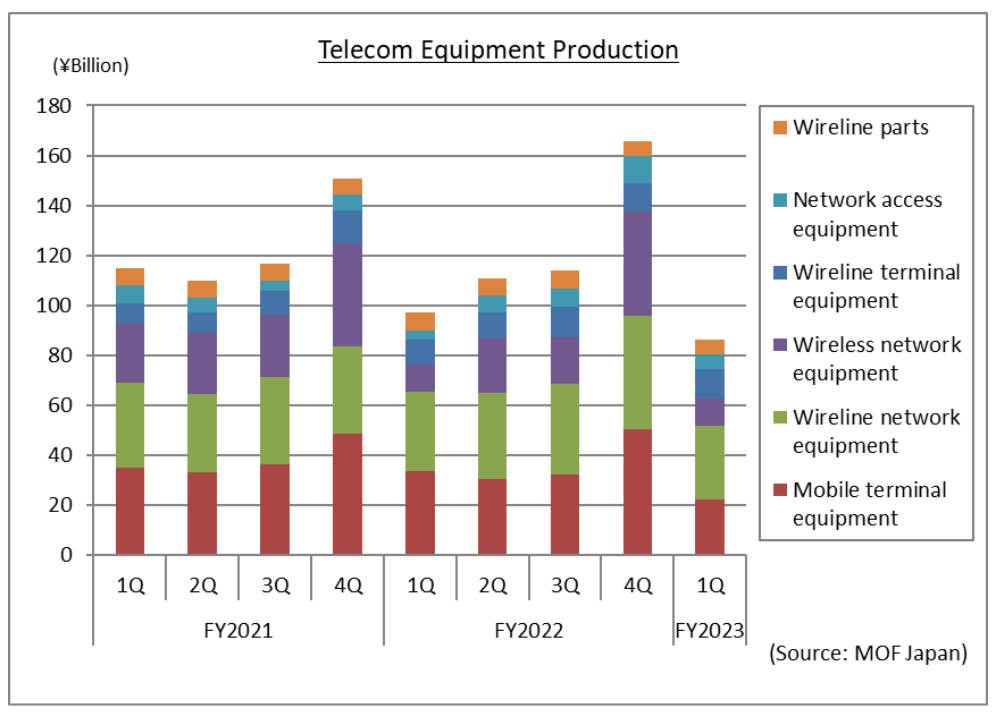

(2) Domestic Production Trends

Domestic production totaled 86.2 billion yen in April through June, a year-on-year decrease of 11.3%. Domestic production decreased after two quarters as the shipping quantity of many types of equipment decreased, partly due to the impact of increased inventory in the previous fiscal year, despite the increased production of many other types which recovered from the difficulty in procuring semiconductor and other parts and materials.

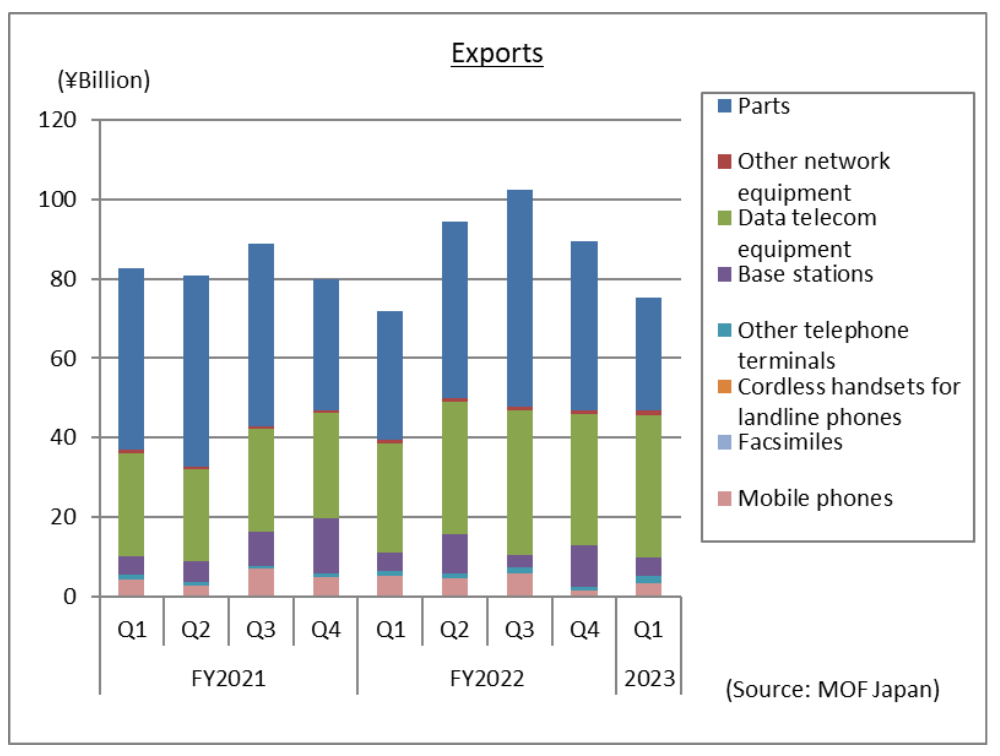

(3) Export Trends

Actual orders received and shipped in the April through June period was 75.4 billion yen, up 4.9% year-on-year. Exports increased for four consecutive quarters, attributable to a rise in exports of data telecom equipment, which offset a fall in exports of parts for globally stagnant smartphones.

(4) Import Trends

In the April through June period, total imports amounted to 663.3 billion yen, a 15.0% decrease year on year. Imports decreased for the first time in the past six quarters, due to a decrease in imports of smartphones produced overseas which reflected weak demand, while imports of data telecom equipment such as routers and switches were brisk.

[Orders Received and Shipped by Japan-based CIAJ Member Companies]

Actual orders received and shipped in the April through June period was 280.7 billion yen, down 18.5% year-on-year. Of which, the total value of domestic shipments was 220.2 billion yen, representing negative growth of 17.2% over the same quarter of the previous year and exports was 60.5 billion yen, representing negative growth of 22.6% over the same quarter of the previous year.

Domestic shipments decreased year on year, given decreases in terminal equipment and network-related equipment. Exports decreased year on year, due to significant decreases in mobile terminals and wireless network equipment, despite increases in wireline terminals and network-related equipment.