The Communication and Information network Association of Japan (CIAJ) announces the telecommunication equipment production and trade figures for FY2022 (April-March) as follows.

[ Overview ]

In FY2022, the telecom market saw a recovery in business equipment such as key telephones, PBXs and cordless telephones for offices against the backdrop of energized business activities due to the easing of parts supply challenges caused by the semiconductor shortage, while there was strong domestic demand for wireline network equipment to enhance network infrastructure in addition to steadily increasing exports supported by the effects of the weaker yen. However, base station communications equipment remained sluggish due to the slow progress of capital investment in 5G SA base stations and millimeter-wave compatible base stations.

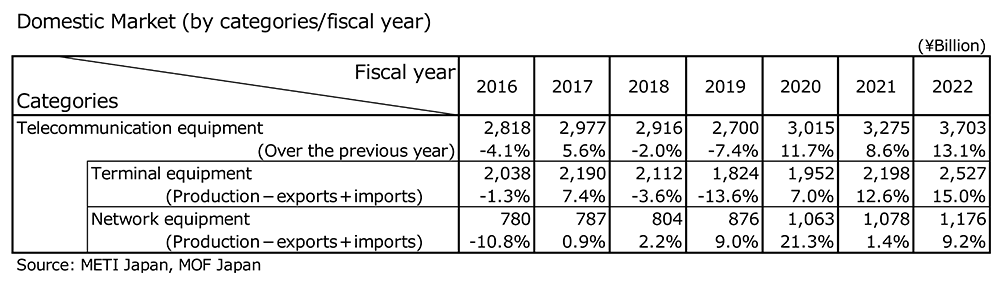

(1) Domestic Market Trends

In FY2022, the total value of the domestic market (value of domestic production – value of exports + value of imports; excluding parts) stood at 3,703.3 billion yen, up 13.1% year over year. The domestic market expanded due to a recovery in the types of equipment which had supply constraints caused by parts shortages resolved and due to an increase in types of equipment of which imports increased thanks to the positive effects of the weaker yen.

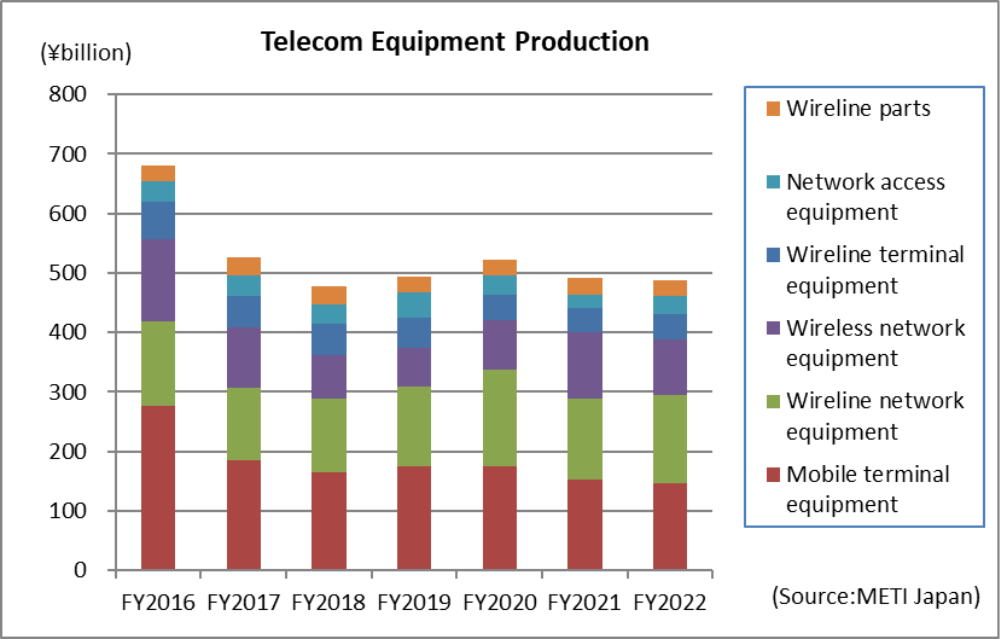

(2) Domestic Production Trends

The total value of domestic production in FY2022 was 484.7 billion yen, 1.0% lower than the previous year. A decrease has been recorded for two consecutive years. Domestic production decreased slightly due to the sluggish production of mobile terminal equipment and wireless network equipment despite steady conveyance device-related production and a recovery in the production of types of equipment that were previously sluggish due to the effects of the restrictions on parts supply.

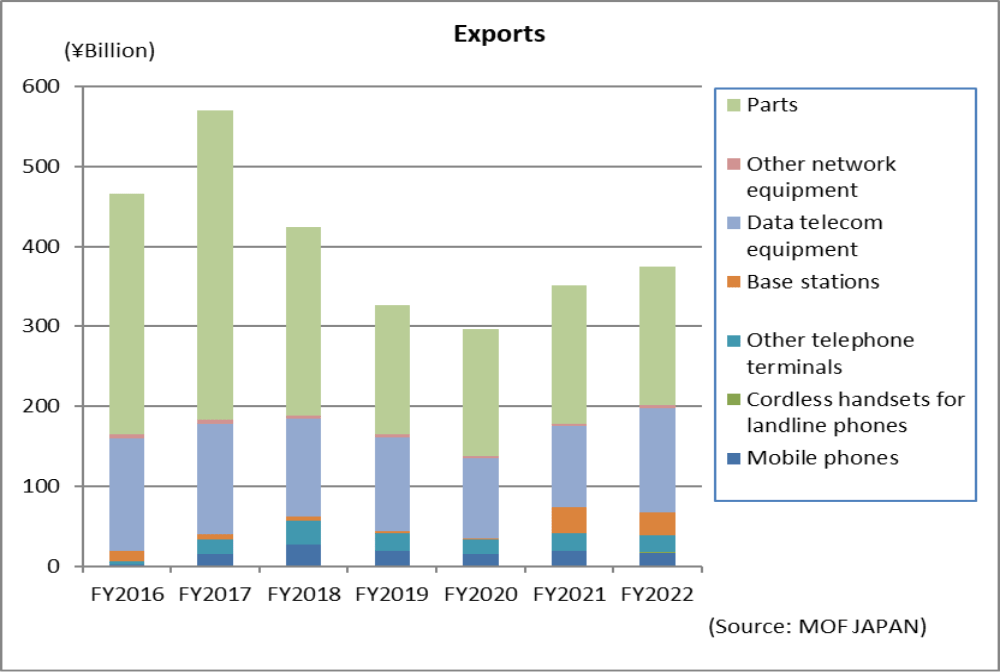

(3) Export Trends

The total figure for exports in FY2022 was 358.0 billion yen, rising 7.7% over FY2021, an increase for the second consecutive year. Although exports of parts decreased affected by the global slowdown in demand for smartphones, exports as a whole grew due to increased exports of network equipment associated with active investment for the enhancement of network infrastructure in addition to the effects of the weaker yen.

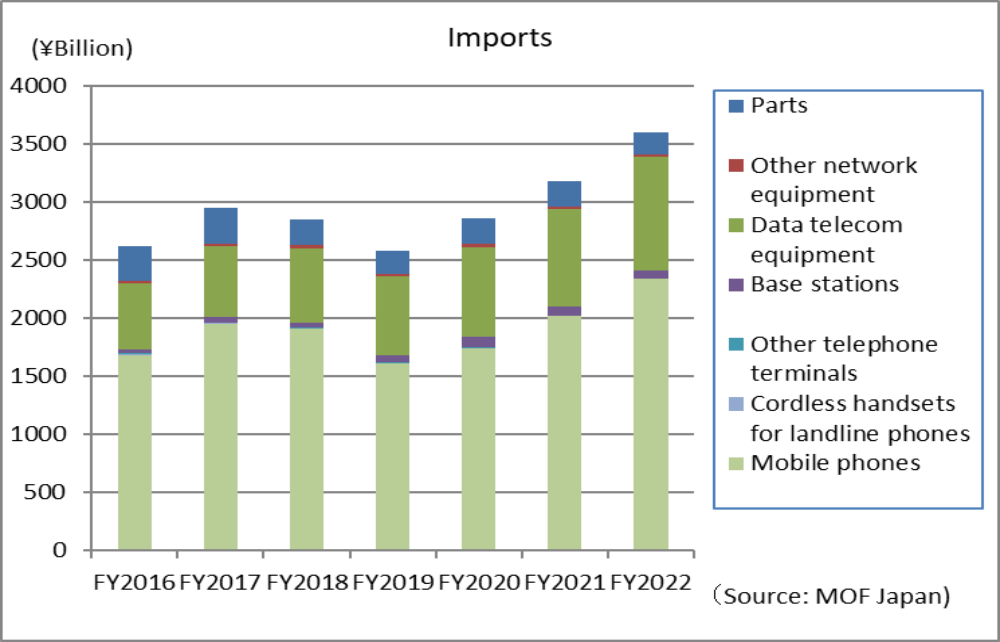

(4) Import Trends

The total figure for imports in FY2022 was 3,612.9 billion yen, an increase of 13.3% over FY2021, exceeding 3 trillion yen for two consecutive years. The number of imported mobile phones decreased as replacement cycles are extended reflecting the rising prices of goods and the rising price of terminals to transfer the soaring materials prices, but the amount of mobile phones imported increased backed by steady demand for high-priced models made by overseas manufacturers and the effects of the depreciation of the yen.

[ Orders Received and Shipped by Japan-based CIAJ Member Companies ]

Actual orders received and shipped in FY2022 were 1,570.9 billion yen, up 13.3% year on year.

Of which the total value of domestic shipments totaled 1,176.7 billion yen, an increase of 5.4% from the previous year) and exports were 394.2 billion yen, an increase of 45.7% from the previous year). Domestic shipments increased year on year with the positive effects of a large fixed communications equipment project that surpassed the negative impact of a decrease in mobile phones which saw their replacement cycles extended. Exports increased year on year partly due to the effects of the weaker yen, despite the slowdown of overseas economies.