[Overview]

In October through December 2022, the telecommunication equipment market saw growth in demand for wireline terminal and wireline network equipment due to the easing of parts supply challenges caused by the effects of the COVID-19 pandemic and semiconductor shortages. Exports of types of equipment that are in strong demand also increased due to the impact of a weaker yen. However, base station communication equipment remained sluggish in the absence of capital investment in 5G SA base stations which utilize the features of 5G.

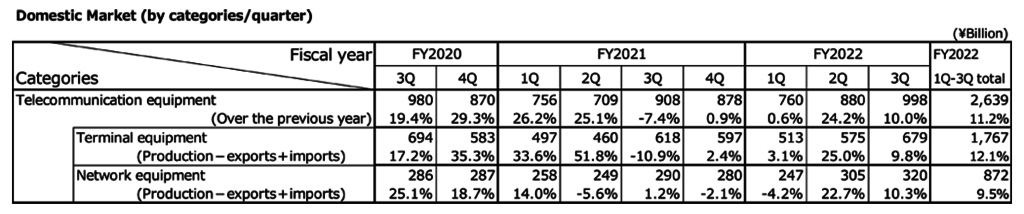

(1) Domestic Market Trends

The domestic market value (domestic production value – export value + import value, excluding components) amounted to 998.4 billion yen in the October through December period, a year-on-year increase of 10.0%. The increase reflects a recovery in production from the slump caused by the effects of restrictions in parts supply, combined with a surge in imports driven by a weaker yen.

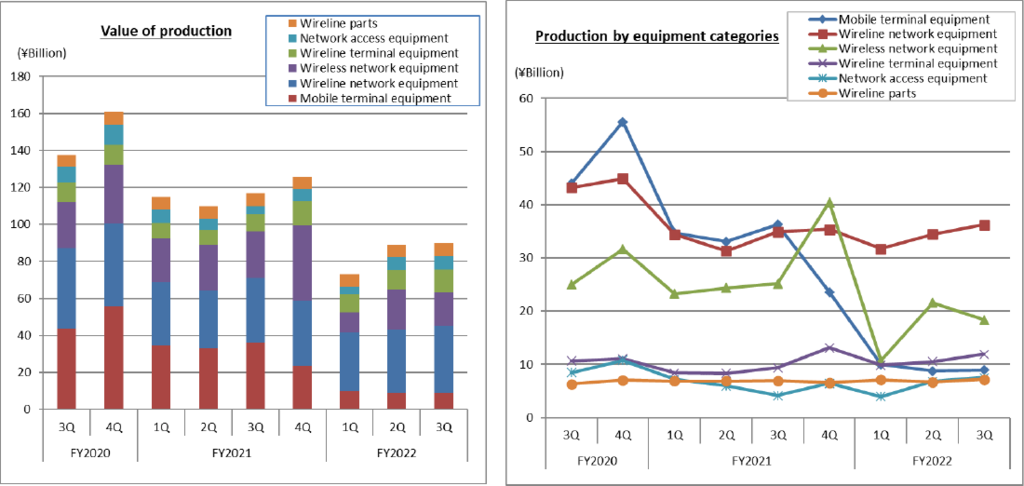

(2) Domestic Production Trends

The value of domestic production in October through December was 90.1 billion yen, representing positive growth of 1.0% over the same quarter of the previous year and marking the second straight positive quarter.

(Year-on-year growth is calculated excluding mobile phone production data, which has become confidential.)

Domestic production increased due to steady conveyance device-related production and recovery in the production of types of equipment that was previously sluggish due to the effects of restrictions on parts supply.

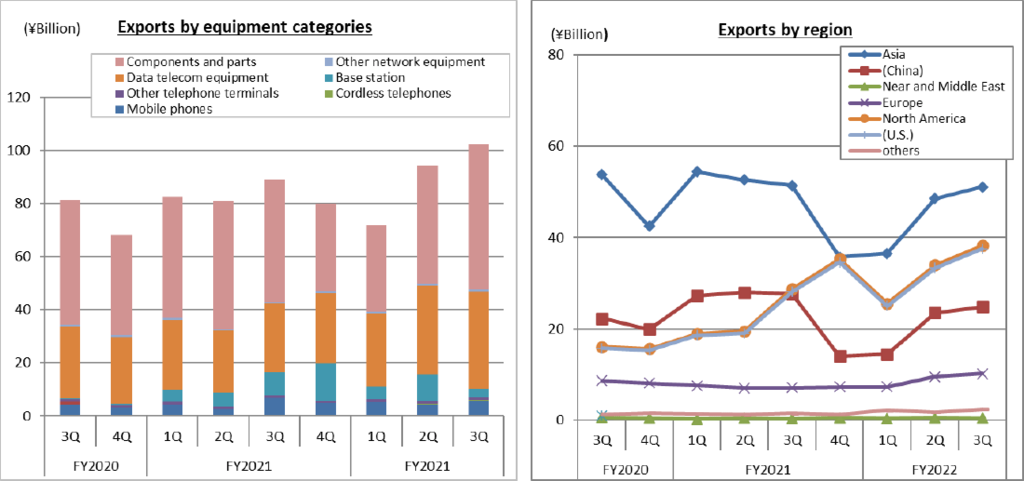

(3) Export Trends

Total exports amounted to 102.4 billion yen for October through December, a year-on-year increase of 15.0%. It has increased for two consecutive quarters. Exports of network equipment increased, unaffected by the slowdown of overseas economies and, with parts shortages also becoming less acute, exports of parts rose for the first time in five quarters.

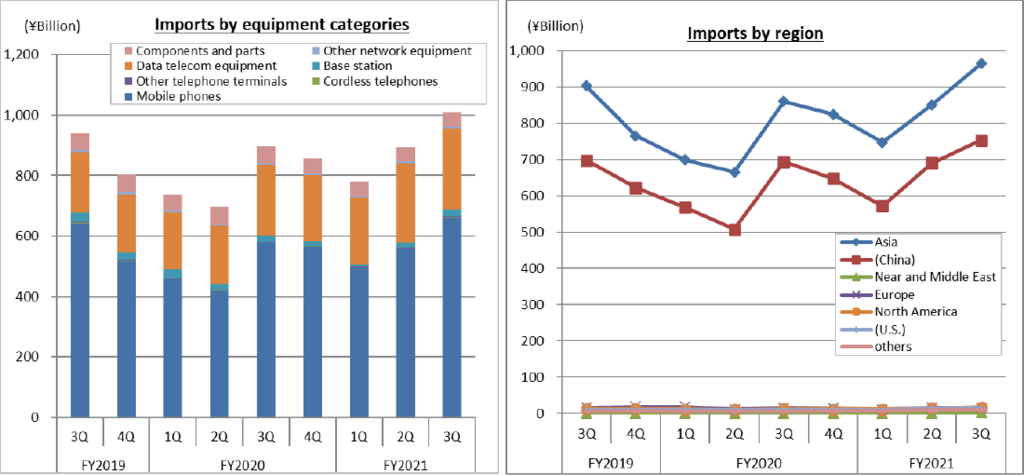

(4) Import Trends

In the October-through-December period, total imports amounted to 1,009.7 billion yen, a 12.6% increase year on year. This was the first time since the third quarter of FY2017 that quarterly imports exceeded 1 trillion yen. Imports of most types of equipment, except parts, increased, partly because the yen lost around 20% of its value against the dollar.

[Orders Received and Shipped by Japan-based CIAJ Member Companies]

Actual orders received and shipped in the October-through-December period was 372.0 billion yen, up 12.0% year-on-year. Of which, the total value of domestic shipments was 249.0 billion yen, representing negative growth of 7.0% over the same quarter of the previous year. The year-on-year decline is largely attributable to falling smartphone demand.

Exports amounted to 123.1 billion yen, representing positive growth of 90.8% over the same quarter of the previous year. The year-on-year increase was due to the recovery of capital investment overseas combined with the impact of a weaker yen.