I. Overview

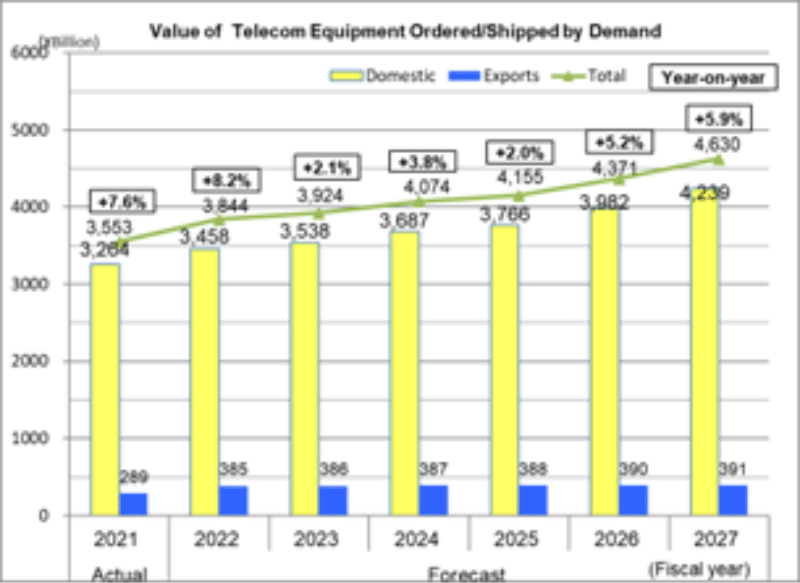

Effective measures to control the spread of COVID-19 and easing limits on economic activities in FY2021 led to a rise in consumer spending and capital investments, but the surge in the number of the omicron variant infections in the latter half of the year caused supply shortages and disruptions in logistics. While the limited availability of supplies weighed down some telecom equipment categories, changes in peoples’ lifestyles, installation of new solutions at offices/factories, rapid acceptance of new digital technologies to transform society (DX) together with building core infrastructure, including telecommunications, and implementation of new technologies, such as 5G, pushed up demand to a total of approximately 3.553 trillion yen (+7.6% year-over-year growth).

Expectations for a sustained economic recovery in FY2022 is high, as socio-economic activities resume a sense of normalcy and many telecom equipment categories are expected to show positive growth, rebounding from low production and unfulfilled orders the previous year due to the supply restrictions. Exports are also expected to be robust as many categories benefit from a weaker yen. Total demand for telecom equipment in FY2022 is forecast at approximately 3.844 trillion yen (+8.2% year-over-year growth).

New services meeting the needs of society and improving the quality of life, such as the metaverse, changes in work styles to improve productivity, new ICT equipment utilizing 5G and beyond 5G/6G technologies and the associated enhancement of telecom infrastructure and networks to support the high speed and volume of data traffic will all contribute to further the shift to digital and the reduction of carbon footprint. The total telecom equipment market value is expected grow to approximately 4.630 trillion yen in FY2027, or an increase of 30.3% over the FY2021 figure.

II. 2022 Forecast

The total telecommunication equipment market figure for FY2022 is forecast at approximately 3.844 trillion yen (+8.2% over FY2021), with the domestic market accounting for about 3.459 trillion yen (+6.0% over FY2021), and exports accounting for 385.2 billion yen (+33.2% over FY2021).

(1) Consumer equipment total: 2.253 trillion yen (+6.0% over FY2021)

- Despite a decrease in the shipment of handsets due to the drop in the value of the yen and rising prices of components leading to higher price tags that will cause consumers to hold back on new purchases and prolong replacement cycles, the total yen value is expected to be higher.

- Steady demand among older adults for cordless phones continues but will not be enough to reverse the overall downward trend. Manufacturers are concentrating efforts to enhance capacity for blocking unwanted telemarketing calls or assisting in identifying calls from scam artists.

(2) Enterprise equipment total: 506.3 billion yen (+19.6% over FY2021)

- Replacements are central to demand for key telephones, PBXs and office-use cordless phones and while investments are shifting towards new work and communication styles, the gradual easing of the supply squeeze for semiconductors will lead to a recovery of domestic demand.

- The trend towards decreasing in-office tasks and the promotion of going digital are negative factors for office-use facsimiles (including multi-functioning facsimiles), but there are signs of capital investments picking up after the prolonged postponement. Overseas demand for multi-functioning machines takes up a large share of facsimile exports and with the weaker yen, the total value is expected to increase.

(3) Infrastructure equipment total: 617.4 billion yen (+12.6% over FY2021)

- Continued investment in digital transmission equipment and base stations for 5G and government budget allocation for disaster-related systems leads to a positive growth forecast. However negative factors are also in play, due to lasting component procurement difficulties from the semi-conductor supply shortage.

- Exports are expected to increase with the gradual recovery of the limitations in supplies from the semi-conductor shortage and the backlog in the supply chain from COVID-19 resulting in the resumption of economic activities abroad. At the same time, telecom carriers rethinking their dependency on single vendors to avoid procurement risks has also led to a positive growth forecast.

(4) Internet equipment total: 307.4 billion yen (+2.6% over FY2021)

- The sudden demand for optical access equipment to accommodate the ”new normal” of COVID-19 has been winding down, but the solid demand for optic fiber cables remains intact. Capital spending in routers to meet 5G network expansion and the traffic surge, mostly in mobile, will push up demand. Demand for LAN switches will also grow as facilities are enhanced to accommodate traffic growth and more numerous devices connecting to the network resulting in investment in its configuration. These trends are all expected to result in the growth in value of demand for this category.

(5) Equipment/parts categories not included above: 159.3 billion yen (+2.5% over FY2021)

III. Midterm Projection

The FY2027 total figure is projected at approximately 4.630 trillion yen (+30.3% growth over FY2021), with the domestic market accounting for about 4.239 trillion yen (+29.9% growth over FY2021) and exports accounting for 391.0 billion yen (+35.2% growth over FY2021).

(1) Consumer equipment total 2.909 trillion yen (+36.8% over FY2021)

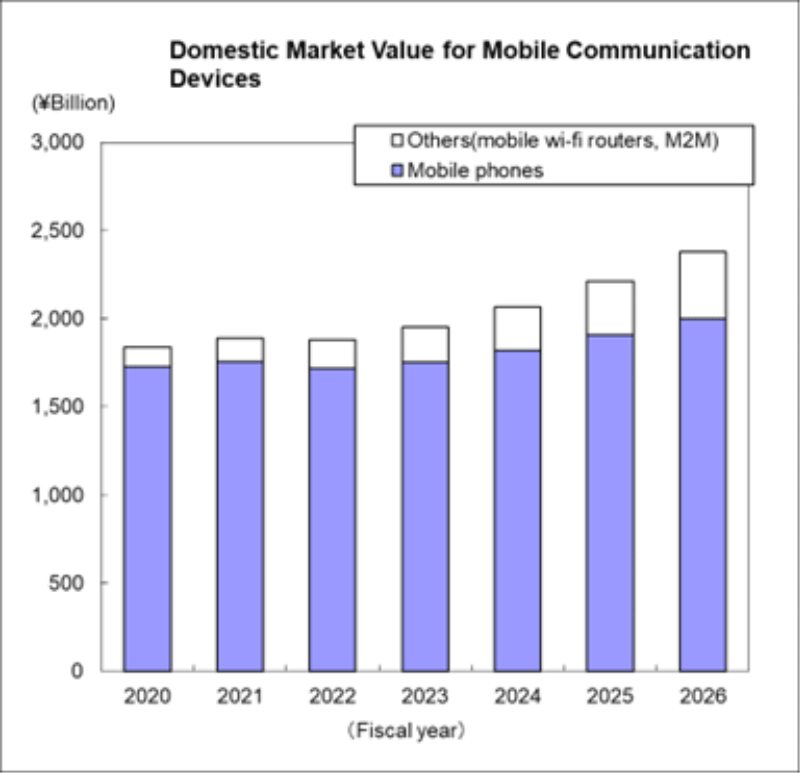

- The domestic demand for mobile communication terminals is forecast to show gradual growth with widespread 5G availability and related services such as the metaverse. This is despite the rising price of handsets resulting from the separation of communication costs from the price of devices and the weaker yen. In addition, greater demand is expected for 5G-compatible M2M modules, which allow simultaneous access by a greater number of devices.

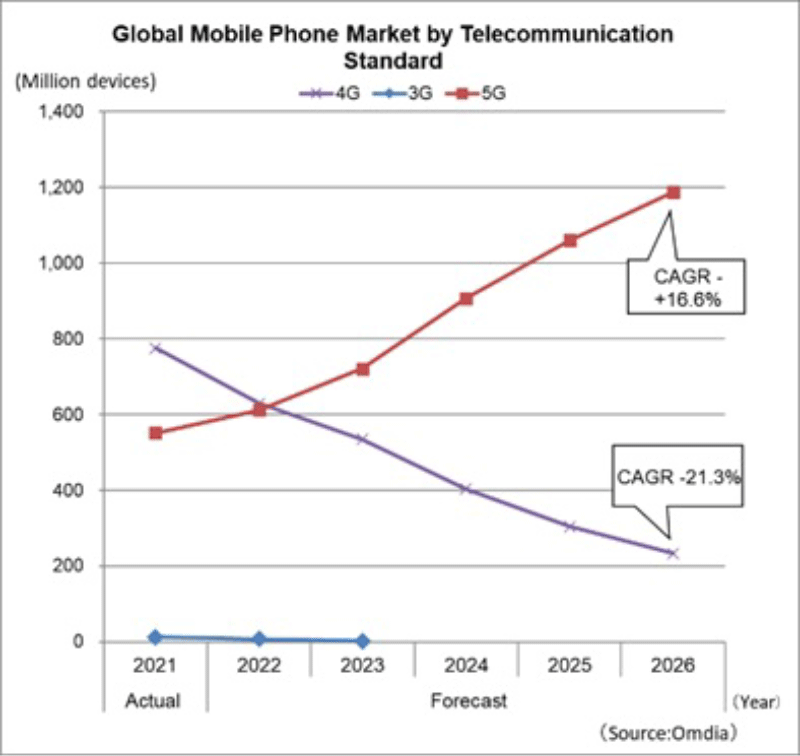

- The global mobile phone market (includes smartphones) in 2021 grew from replacement demand for 5G handsets, mainly in developed countries, despite worries of supply issues resulting from the shortage in semi-conductors. The instability of the supply-chain caused by lockdowns from the zero-COVID policy in China and concerns over geo-political circumstances are expected to dampen consumer appetites and revert to negative demand for 2022. These trends are forecast to ease from 2024 onwards, with increase in demand for replacement 5G handsets, culminating in sales revenue in 2026 projected at 401.7 billion U.S. dollars (CAGR +1.0%).

- Overall demand for cordless phones is forecast to continue declining with widespread use of smartphones and mobile devices and the market will mainly focus on use among older adults. However, it is not expected to drop below the figure for FY2021, which experienced a significant drop due to shortages in supplies and manpower at overseas manufacturing sites.

(2) Enterprise equipment total: 463.3 billion yen (+9.5% over FY2021)

- Replacement is the core to demand for key telephones, PBXs and office-use cordless phones. The restructuring of voice communication platforms at offices in connection with work style transformation and further adoption of cloud services are expected to result in a slight decrease.

- The domestic market for office-use facsimiles (including multi-functioning facsimiles) will continue to decline with changes in work style and the shift to digital at both private sector and government offices. However, exports are forecast to surge compared to FY2021 as component supply issues are resolved and also due to the weaker yen.

(3) Infrastructure equipment total: 751.2 billion yen (+37.0% over FY2021)

- Demand for infrastructure equipment will slow by FY2023 as the round of investment towards high-speed/large volume 5G wanes, but is expected to increase overall, as networks continue to be enhanced to accommodate the surge in traffic from 5G, local 5G and IoT services, the market embracing large volume streaming services, including 4K/8K contents, xR contents, like AR/VR and metaverse, as well as network slicing and edge computing, shifts to even more data centers with greater volume and speed capacities and demand growth for disaster information systems.

- Exports are expected to continue its growth. This is partly due to telecom carriers abroad moving away from relying on single vendor procurement to reduce dependency risks from FY2020, giving Japanese vendors a chance to enter overseas carrier ecosystems and the emergence of O-RAN business opportunities.

(4) Internet equipment total: 339.5 billion yen (+13.3% over FY2021)

- The Internet equipment market will continue to address traffic growth from expansion of 100Gbps optical and 5G network coverage and the further popularity of video content. The embracing of cloud services and related virtual technologies and higher cost of components due to the weaker yen translating into higher price tags for the finished product are negative factors, but positive growth is projected for the category with video communications taking hold at businesses and corporate contents becoming richer, moves towards 5G compatibility, new uses of networks like Wi-Fi 6, xR technologies, metaverse and wider use of digital twin computing leading to traffic growth as well as a return of manufacturing facilities to Japan.

(5) Equipment/parts categories not included above: 166.2 billion yen (+7.0% over FY2021)

IV. Market Trends

(1) Potential of Web3 (blockchain technology)

- Introduces and summarizes the impact and possibilities of Web3, or blockchain technology, and its derivative technologies – NFT (non-fungible token), DeFi (decentralized finance), ReFi (regenerative finance) and DAO (decentralized autonomous organization.

- Blockchain, a basic technology of Web3.

- Trends in economic security and information security.

- Emergence of cloud services in the new normal.

(2) ICT applications in Japan’s digital policies

- The section will provide an overview of the Japanese government’s “Vision for a Digital Garden City Nation,” looking at the Digital Agency’s measures, achievements and challenges. It will also consider what impact several national policies, including those concerning carbon neutrality, strengthening Japanese territory and assuring economic stability will have on demand trends in info-communication equipment.

- “Vision for a Digital Garden City Nation” and the Digital Agency’s achievements and challenges.

- Trends in carbon neutrality, strengthening Japanese territory and assuring economic stability.

(3) Services expected to growth with the utilization of ICT

- Looks at specific use case scenarios that have emerged from new trends and technologies mentioned in “(1) Possibilities of Web3 (blockchain technology).”

- Embracing of Web3, NFT, DAO, DeFi and metaverse by the economic society.

- The spread of xR technologies in various industries and new developments.

[Forecasting methodology]

- Domestic market forecast: Based on past actual orders received and shipment statistics compiled by CIAJ. For areas not covered by CIAJ, we received the cooperation of InfoCom Research, Incorporated and interviewed CIAJ members.

- Global market forecasts: Data and analysis provided by the global research company Omdia was referred to and utilized with the cooperation of InfoCom Research, Incorporated.