The Communications and Information network Association of Japan (CIAJ) announces the telecommunication equipment production and trade figures for April through September, 2022 as follows.

I. Summary

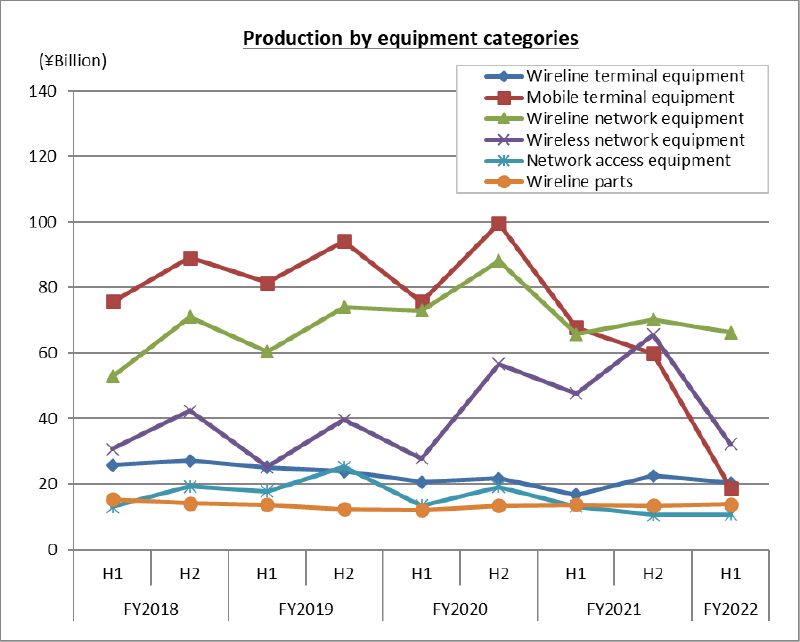

In the telecom market from April to September 2022, demand for key telephones and PBXs increased while the difficulty of purchasing their components began to decrease. Demand for facsimile machines (including multifunction machines) also grew with strong exports backed by a weaker yen. Meanwhile, demand related to 5G base stations was sluggish, reflecting a slowdown in investments in the NSA system for the development of high-speed, high-capacity areas.

II. Domestic Market Trends

The domestic market value (domestic production value – export value + import value, excluding components) amounted to 1,685.2 billion yen in the April through September period, a year-on-year increase of 15.1%.

The domestic market value increased, offsetting a decrease in domestic production value, due in part to an increase in the import of smartphones, including a high volume of shipments of summer models.

III. Domestic Production Trends

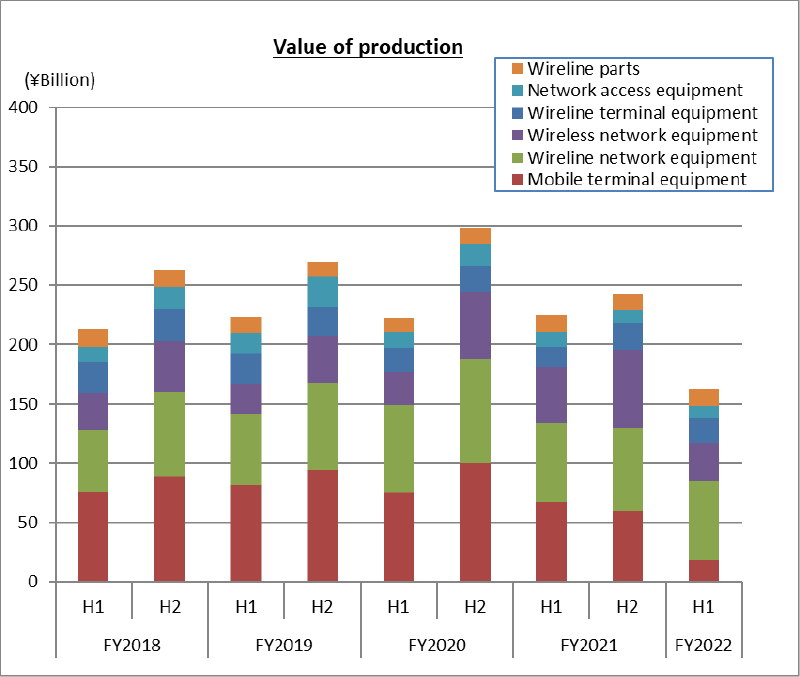

Domestic production totaled 206.9 billion yen in April through September, a year-on-year decrease of 8.0%.

Production of business-related devices increased as the difficulty of purchasing components began to ease. However, domestic production declined in two consecutive half-year periods principally due to a slowdown in demand for communication infrastructure.

IV. Export Trends

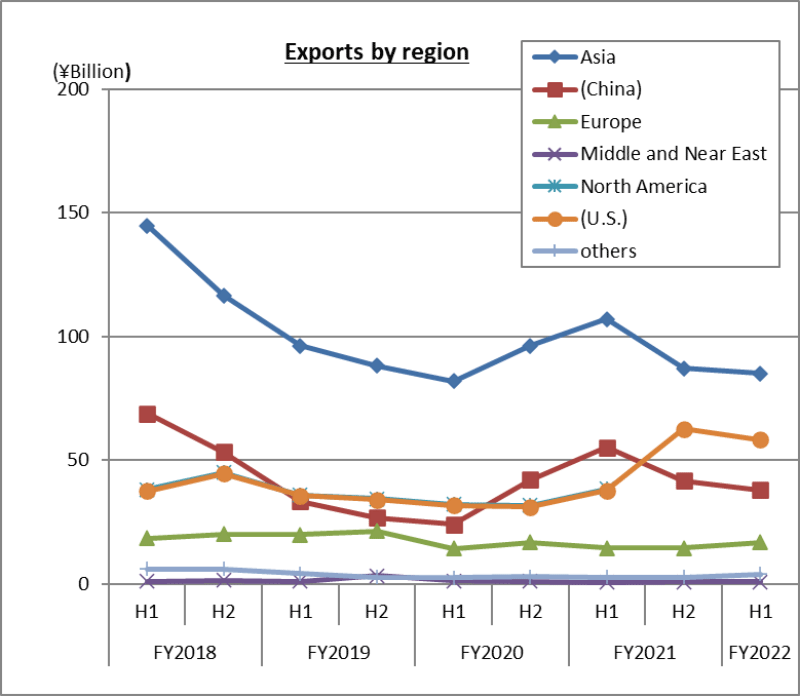

Actual orders received and shipped in the April through September period was 166.1 billion yen, up 1.7% year-on-year.

While the export of components used in overseas smartphone production decreased, export value grew in three consecutive half-year periods thanks to growth in demand in overseas markets where the resumption of economic activity is increasing.

V. Imports

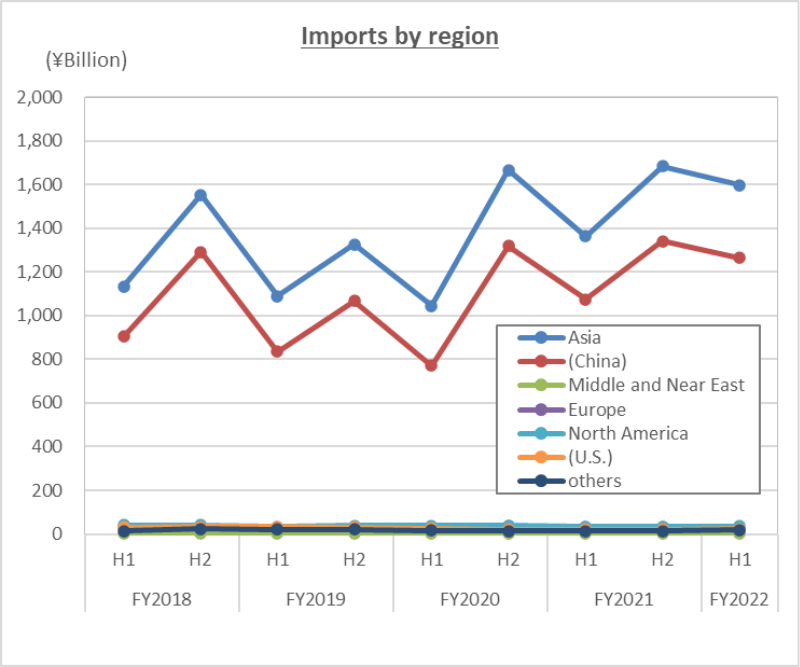

In the April through September period, total imports amounted to 1,673.6 billion yen, a 16.8% increase year on year.

The import value increased in four consecutive half-year periods thanks to strong sales of data communication devices, including routers and switches and transmission equipment, in line with demand for the transition of networks to fiber-optic cables, in addition to the high domestic demand for smartphones.

[Orders Received and Shipped by Japan-based CIAJ Member Companies]

Actual orders received and shipped in the April through September period was 704.5 billion yen, up 5.1% year-on-year.

Of which the total value of domestic shipments totaled 523.6 billion yen, a decrease of 1.3% over the same quarter of the previous year and exports was 181 billion yen, an increase of 29.8% over the same quarter of the previous year.

Domestic shipments decreased year on year due to a fall in shipments of mobile terminals and network equipment despite an increase in wireless, satellite-based products while wired terminal equipment and network equipment increased. Exports grew year on year as a result of a significant increase in wired terminals and network equipment partly due to economic recoveries overseas.