|

I. Overview of the Japanese Economy

The Japanese economy during the April through June period of FY2025 recorded a GDP growth of 0.5% year on year (second preliminary figure on September 8) in real terms, excluding the effect of price fluctuation, or annualized growth of 2.2%. Personal consumption, the central pillar of domestic demand, grew 0.4%. Due to extreme summer heat, food service utilization was accelerated, while the consumption of game software and personal computers was strong. On the other hand, investment in software decreased, to a mere 0.6% rise in corporate capital investment, while overall capital investment continued to show the trend of a gradual increase due to high levels of corporate earnings together with boost from digital, labor-saving and research and development investments, etc. Regarding overseas demand, exports and imports increased 2.0% and 0.6%, respectively. Both domestic and overseas demand showed no significant adverse impact from the downward pressure triggered by US reciprocal tariffs, and the economy maintained a moderate recovery in the April through June period.

II. Overview of the Telecom Market

In the April through June period of FY2025, the domestic market for terminal equipment expanded its scale with an increase in imports of smartphones. Domestic telecom carriers’ investment in network-related equipment is recovering (the production and imports of some models are on an increasing trend), in preparation for the strengthening of telecommunications infrastructure and brisk demand for data centers, despite a decrease for the first time in the last five quarters. With regard to base station communication equipment, the government’s 5G population coverage target was briefly achieved on the basis of a total figure for all mobile carriers. However, in light of the fact that there is still room for additional investment on a company level and that the Ministry of Internal Affairs and Communications recently announced the “Digital Infrastructure Development Plan for2030,” it will be necessary to continue promoting the construction of a network environment that supports new digital infrastructure and technologies through collaborative efforts between the public and private sectors.

Regarding an overview of the first quarter, although any adverse effects of US reciprocal tariffs are yet to become evident, the future remains uncertain, and it is necessary to aim for global development in close collaboration with the Japanese government.

(1) Domestic Market Trends

The domestic market value (domestic production value – export value + import value; excluding parts) amounted to 870.4 billion yen in the April through June period of FY2025, a year-on-year increase of 12.0%. The domestic market value increased, attributable to expanded imports of smartphones made by major overseas manufacturers and a rise in domestic production.

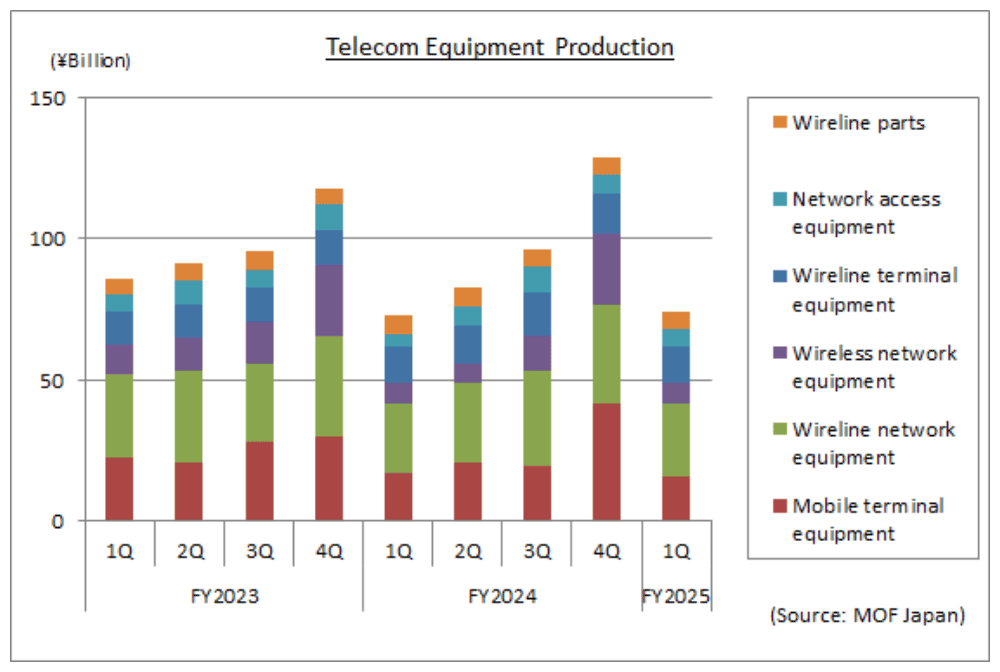

(2) Domestic Production Trends

The total value of domestic production amounted to 74.4 billion yen, a year-on-year increase of 2.4%. Domestic carriers’ investment in intercom systems with new functions and carrier transmission systems (including digital transmission equipment) increased, showing a recovery trend. The increase reflected a greater-than-expected increase in networking equipment backed by fixed-line communication equipment which was supported by disaster prevention measures and demand for reconstruction from disasters, the construction of data centers and increase in data traffic.

Although the value of base station communication equipment in the first quarter decreased compared to a year ago, its volume increased and its production is on a recovery trend in line with increases in actual orders received (CIAJ voluntary statistics) and exports.

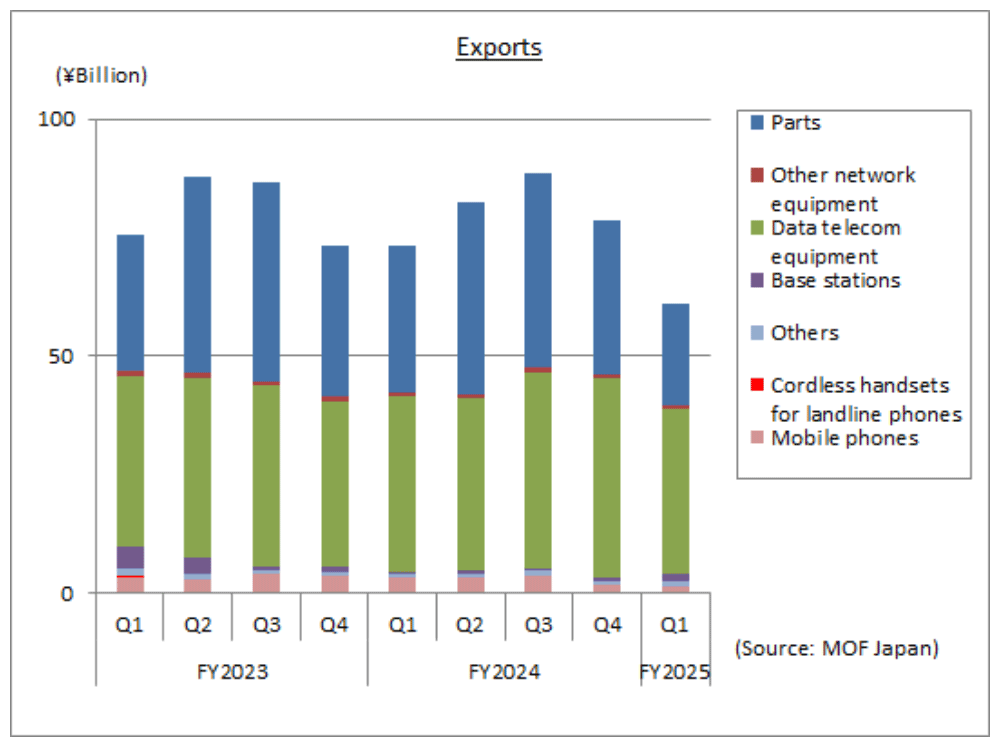

(3) Export Trends

In FY2025, total exports in the April through June period amounted to 61.1 billion yen, a 16.5% decrease year-on-year. The value of exports decreased significantly, due to the continued downturn of smartphones from domestic manufacturers, and in particular a greater-than-expected decrease in data telecom equipment and parts in the first quarter.

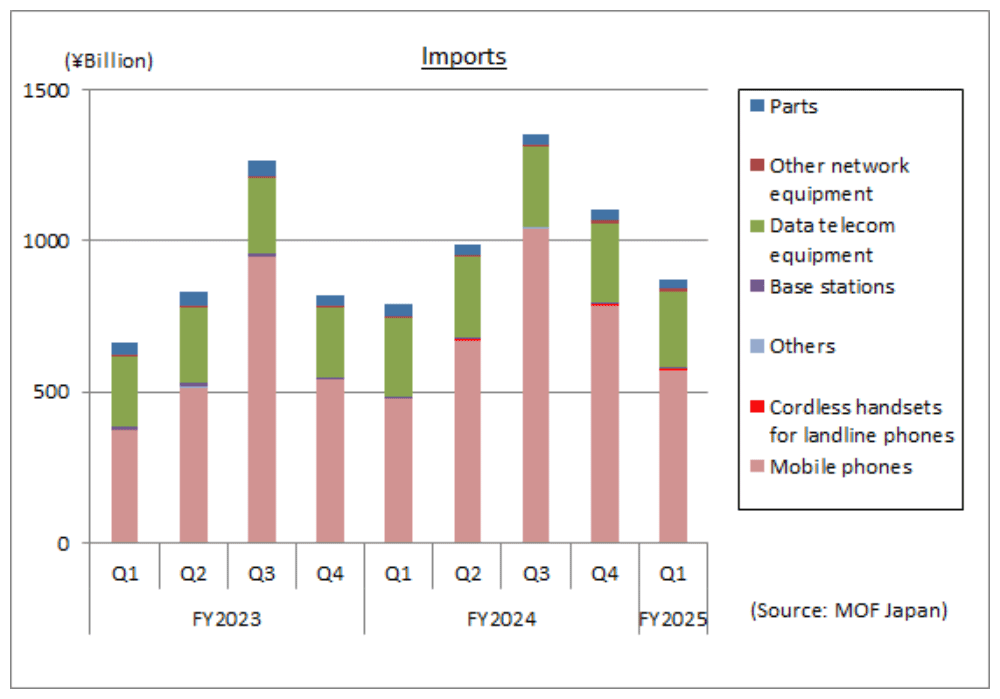

(4) Import Trends

In FY2025, total imports in the April through June period amounted to 871.0 billion yen, a 10.4% increase year on year. Total imports increased significantly, attributable to brisk domestic demand for smartphones, despite decreases in data telecom equipment and parts. It is apparent that increases in smartphones are pushing up almost all the increase in imports.

III. Trends in Orders Received and Shipped (CIAJ statistics orders received and shipped)

Orders received and shipped by Japan-based CIAJ member companies in the April through June period amounted to 249.5 billion yen, up 1.3% year on year. Of which the total value of domestic shipments totaled 197.4 billion yen, representing positive growth of 4.5% over the same quarter of the previous year and the total value of domestic exports was 52.0 billion yen, representing negative growth of 9.5% over the same quarter of the previous year.

Domestic shipments increased year on year, attributable to a significant rise in demand for fixed-line communication equipment in wireless network equipment from government sectors, despite a decrease in wireline terminal equipment and wireline network equipment. Exports decreased year on year, reflecting a decrease in digital transmission equipment and fixed-line communication equipment, despite an increase in facsimile machines, base station communication equipment and other network-related equipment (routers, LAN switches).

* CIAJ Statistics for orders received and shipped = orders received and shipped by Japan-based CIAJ member companies

(= value of domestic shipments + value of exports = value of domestic production + value of imports of products produced overseas)