|

I. Overview of the Japanese Economy

In FY2024, the Japanese economy saw real GDP grew 0.8% year on year according to the second preliminary figures on June 9. This is positive growth for the fourth consecutive year (Annualized growth for the January-March period was -0.2%, a negative figure for the first time in four quarters.). Private consumption increased 0.8%. In addition to the normalization of automobile sales, demand for stockpiles grew in preparation for disasters after a Nankai Trough earthquake advisory was issued in the summer of 2024. Purchases of smartphones also increased following the release of new models. Capital investment climbed 2.6%, due to rising demand following the implementation of digital transformation initiatives, buoyant investment related to computers including servers and the construction of new semiconductor-related plants. Regarding overseas demand, consumption by inbound tourists, which is statistically included in exports, remained strong. The increase of smartphone imports following the release of new models of smartphones impacted imports to some degree.

II. Overview of the Telecom Market

In FY2024, the telecom market continued its downward trend, reflecting the adjustment of inventories of existing models of wireline terminal equipment with an eye toward the introduction of new models and the transition to smaller equipment. Telecom carriers’ investment in wireline network equipment continued to be restrained. Given, in particular, that the nationwide 5G population coverage target was achieved two years ahead of schedule, new construction goals regarding the Sub6 rollout ratio and the number of millimeter wave base stations did not lead to new investments in wireless base station communication equipment.

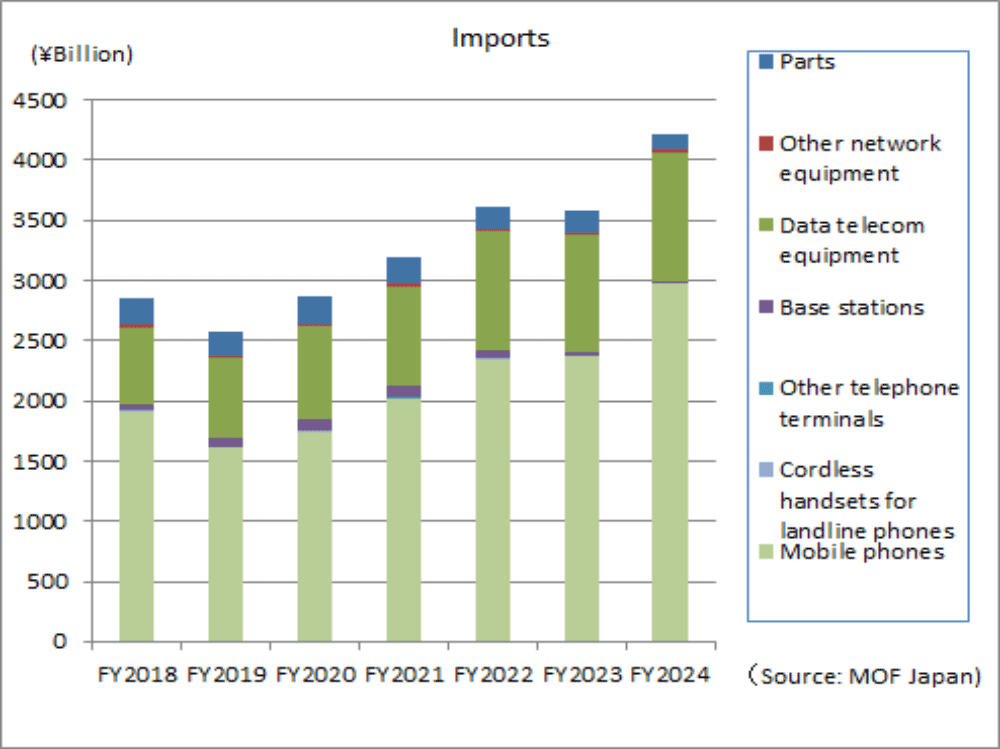

At the same time, domestic demand for smartphones made by leading overseas manufacturers remained brisk in FY2024. Imports of data telecom equipment increased to increase the amount of data center equipment in response to the growth of high-speed large-capacity data traffic. Consequently, the domestic market expanded.

(1) Domestic Market Trends

The domestic market value (domestic production value – export value + import value; excluding parts) amounted to 4,272.7 billion yen in FY2024, a year-on-year increase of 18.8%. The domestic market value increased. While domestic production continued to decline, imports of smartphones and data telecom equipment increased.

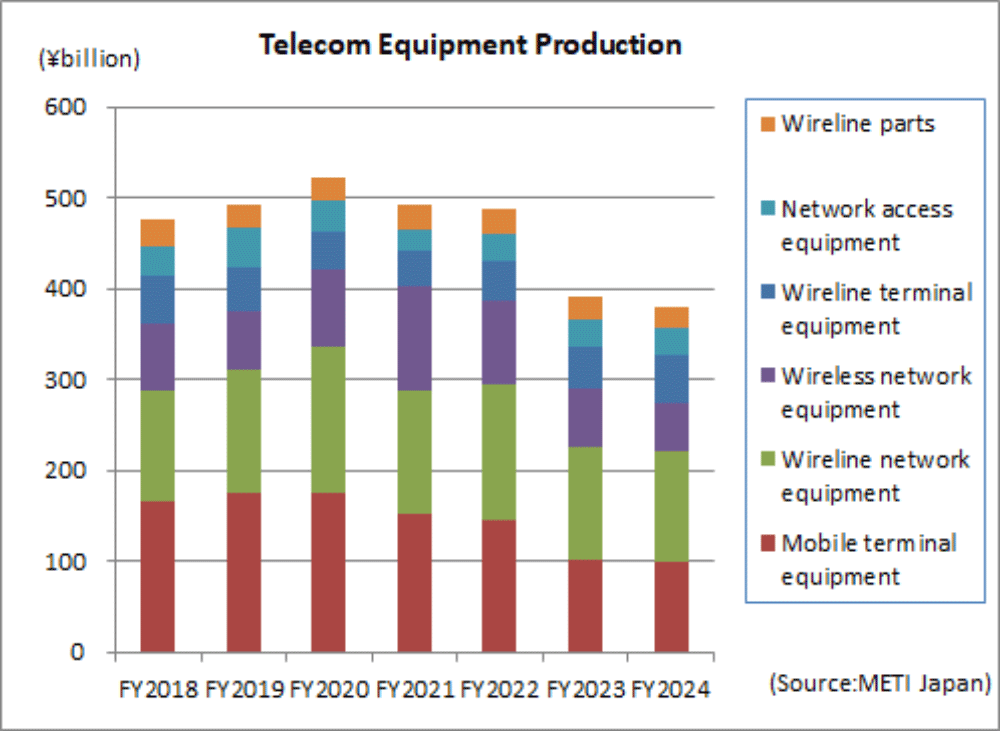

(2) Domestic Production Trends

The total value of domestic production in FY2024 was 380.5 billion yen, a decrease of 2.7% over FY2023. The decline reflected the reduction of the production of land communication devices, including mobile phones, and base station communication equipment, while the production of smartphone-linked intercom systems and intercom systems with recording functions increased and also fixed-line communication equipment increased in association with disaster prevention measures.

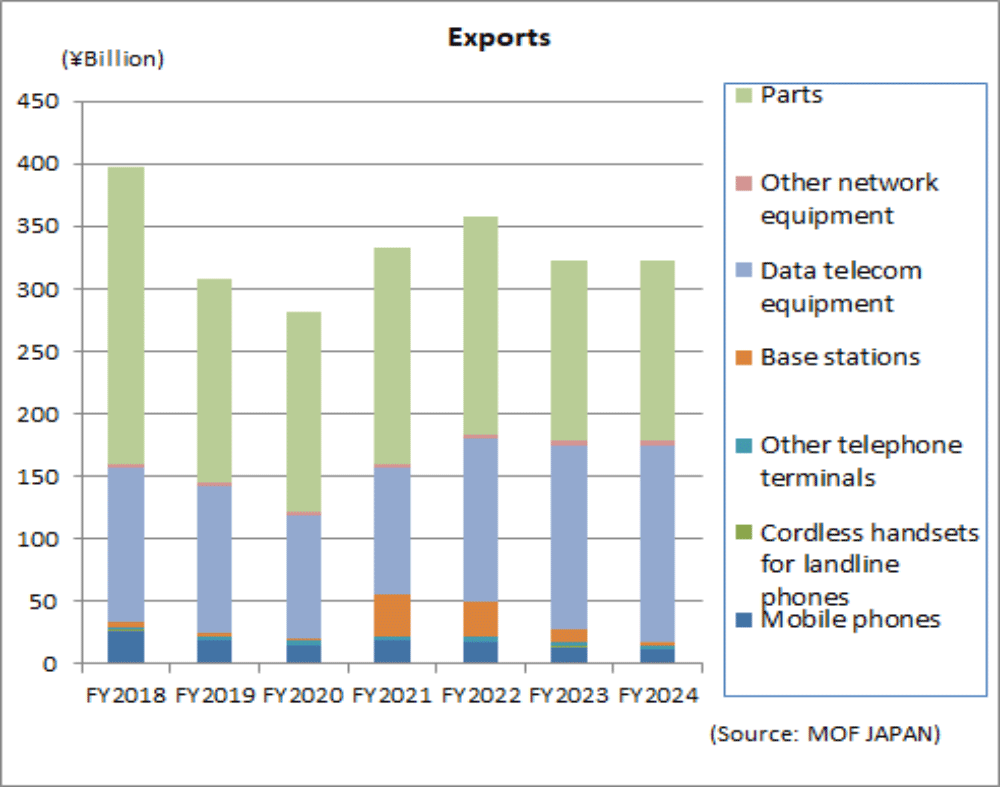

(3) Export Trends

In FY2024, total exports amounted to 322.6 billion yen, which is almost no change year on year. The rise of overseas manufacturers has led to the continued weakness of smartphones from domestic manufacturers. Exports of base stations decreased due chiefly to overseas carriers controlling their investments. However, exports of data telecom equipment increased mainly due to investments in data centers overseas. Accordingly, the total was maintained at the level of the previous year.

(4) Import Trends

In FY2024, total imports amounted to 4,230.2 billion yen, an 18.1% increase year on year. In FY2024, there was strong demand for smartphones in Japan which was supported by the launch of new models from major overseas manufacturers, a last-minute surge in purchases ahead of the revision of the Ministry of Internal Affairs and Communications’ guidelines at the end of 2024, and replacement purchases at the end of FY2024, before the season when people often change jobs or begin school. Demand for data telecom equipment and other equipment remained strong due to the expansion of facilities in response to the increased domestic demand for data centers. All of these factors contributed to the increase of total imports.

III. Trends in Orders Received and Shipped

Orders received and shipped by Japan-based CIAJ member companies amounted to 1,146.9 billion yen, down 1.9% year on year. Of which the total value of domestic shipments totaled 886.7 billion yen, a decrease of 5.8% year on year, and exports was 260.2 billion yen, an increase of 14.1% year on year.

Domestic shipments decreased year on year, reflecting the decrease of shipments of mobile terminal equipment and wireline network equipment. At the same time, demand increased considerably for fixed-line communication equipment, under wireless network equipment. Specifically, demand for terrestrial equipment for government agencies that have government budgets related to disaster prevention and for satellite equipment for carriers increased. Exports leaped significantly, driven by the increase in exports of facsimile machines, digital transmission equipment and wireless network equipment in general.

* CIAJ Statistics for orders received and shipped = orders received and shipped by Japan-based CIAJ member companies

(= value of domestic shipments + value of exports = value of domestic production + value of imports of products produced overseas)